Welcome to the world of online banking in Canada, where convenience meets innovation! Gone are the days of long lines and tedious paperwork at traditional brick-and-mortar banks. With just a few clicks, you can access all your financial needs from the comfort of your own home. In this blog post, we will explore the top 10 best online banks in Canada that are revolutionizing the way we manage our money. Whether you’re looking for high-interest rates, low fees, or seamless digital experiences, these online banks have got you covered. So grab your laptop or smartphone and get ready to embark on a virtual banking journey like no other!

Top 10 Best Online Banks in Canada

1. Alterna Bank

Alterna Bank is one of the top online banks in Canada, offering a range of innovative financial services to meet the needs of its customers. With a strong focus on providing personalized banking solutions, Alterna Bank has gained recognition for its customer-centric approach.

One of the key advantages of banking with Alterna Bank is its competitive interest rates. Whether you’re looking to save or borrow money, Alterna offers attractive rates that can help you achieve your financial goals. This makes them an excellent option for individuals who want to maximize their savings and minimize their borrowing costs.

In addition to favourable interest rates, Alterna Bank also provides convenient and user-friendly digital banking platforms. Their online and mobile banking tools allow customers to easily manage their accounts, transfer money, pay bills, and access other essential banking services from anywhere at any time.

Another notable feature offered by Alterna Bank is its commitment to ethical investing. They have a dedicated socially responsible investment portfolio that aligns with environmental sustainability principles while delivering solid returns for investors.

2. PC Financial

PC Financial, a subsidiary of Loblaw Companies Limited, is one of the leading online banks in Canada. With its user-friendly interface and extensive range of banking services, PC Financial has gained popularity among Canadians looking for convenient and reliable online banking options.

When it comes to savings accounts, PC Financial offers competitive interest rates that help customers grow their money effortlessly. Whether you’re saving for a rainy day or planning for the future, PC Financial provides flexible options tailored to your financial goals.

For those who prefer earning rewards on their everyday purchases, PC Financial’s credit card selection is worth exploring. From cashback cards to travel rewards cards, there’s something for everyone. Plus, with no annual fees and access to exclusive discounts at participating stores within the Loblaw family of companies, these credit cards offer exceptional value.

3. Manulife Bank

Manulife Bank is a reputable online banking option in Canada that offers a range of financial services to meet the needs of its customers. With its user-friendly interface and innovative features, Manulife Bank provides convenience and flexibility for individuals looking to manage their finances efficiently.

One of the key advantages of Manulife Bank is its competitive interest rates on savings accounts, making it an attractive choice for those looking to grow their money. Additionally, the bank offers various investment options, such as GICs and mutual funds, allowing customers to build wealth over time.

Another notable feature of Manulife Bank is its mortgage options. Whether you are a first-time homebuyer or looking to refinance your current mortgage, Manulife Bank provides flexible repayment terms and competitive rates.

If you’re seeking an online bank in Canada that combines competitive rates with top-notch customer service and a wide range of financial products, consider giving Manulife Bank a try!

4. Achieva Financial

Achieva Financial is another top online bank in Canada that offers a range of banking services to its customers. With Achieva Financial, you can enjoy the convenience of online banking from anywhere at any time. They pride themselves on their competitive interest rates and no-fee accounts.

One of the standout features of Achieva Financial is its high-interest savings account, which allows you to earn more on your savings compared to traditional banks. This can be especially beneficial if you’re looking to grow your money over time or save for a specific goal.

In addition to their savings account, Achieva Financial also offers GICs (Guaranteed Investment Certificates) with different terms and rates depending on your investment goals. These options provide flexibility and opportunity for customers who want secure long-term investments.

Another advantage of banking with Achieva Financial is its commitment to customer service. They have a team of knowledgeable professionals available by phone or email to assist with any questions or concerns you may have about your accounts or transactions.

5. EQ Bank

EQ Bank is one of the top online banks in Canada, offering a wide range of innovative financial products and services. With its user-friendly interface and competitive interest rates, EQ Bank has gained popularity among Canadians looking for convenient and efficient banking solutions.

One of the standout features of EQ Bank is its high-interest savings account. This account offers a competitive interest rate that helps your money grow faster than traditional brick-and-mortar banks. Plus, there are no monthly fees or minimum balance requirements, making it an attractive option for those seeking to maximize their savings.

In addition to its savings account, EQ Bank also offers GICs (Guaranteed Investment Certificates) with various terms and rates. These secure investment options provide you with peace of mind while earning you solid returns on your money.

EQ Bank stands out as one of the best online banks in Canada due to its user-friendly interface, competitive interest rates, and exceptional customer service. Whether you’re saving for a short-term goal or planning for the future, EQ Bank offers reliable financial solutions tailored to meet your needs

6. KOHO

KOHO is an innovative online bank that has quickly gained popularity in Canada. With its user-friendly interface and attractive features, it’s no wonder why so many people are turning to KOHO for their banking needs.

One of the standout features of KOHO is its prepaid Visa card. This allows users to spend only what they have loaded onto the card, helping them stay within their budget and avoid overspending. Plus, with KOHO’s real-time transaction tracking, users can easily monitor their spending habits and make adjustments as needed.

Another great feature of KOHO is its savings goals tool. Users can set up multiple savings goals within their accounts and track their progress toward each one. Whether you’re saving for a vacation or a down payment on a house, this feature makes it easy to stay motivated and achieve your financial goals.

In addition to these features, KOHO also offers cashback rewards on certain purchases made with the prepaid Visa card. This means that every time you use your card at participating retailers, you’ll earn cashback that can be redeemed towards future purchases or transferred into your savings account.

KOHO provides a fresh take on online banking in Canada with its intuitive platform and unique features like prepaid cards and savings goals tools. It’s definitely worth considering if you’re looking for a modern banking experience that puts control back in your hands!

7. Motusbank

Motusbank is a relatively new player in the Canadian online banking scene, but it has quickly gained recognition for its competitive offerings. With its focus on providing a user-friendly digital experience and attractive interest rates, Motusbank has become a popular choice for those looking to manage their finances online.

One of the standout features of Motusbank is its high-interest savings account, which offers an impressive rate that can help you grow your savings faster. This makes it an excellent option for individuals who want to maximize their returns while still having easy access to their funds.

In addition to its savings account, Motusbank also offers a range of other products and services, including chequing accounts, best mortgage rates, loans, and lines of credit. Whether you’re looking for day-to-day banking solutions or long-term financial planning options, Motusbank has something to offer.

Another advantage of choosing Motusbank as your online banking provider is its commitment to exceptional customer service. The bank prides itself on being responsive and helpful when dealing with inquiries or issues raised by customers.

With its competitive rates and comprehensive product lineup combined with excellent customer service standards, Motusbank stands out as one of the top choices among Canadian online banks.

8. Simplii Financial

Simplii Financial, formerly known as PC Financial, is an online bank that offers a wide range of banking services to Canadians. With its user-friendly interface and convenient mobile app, Simplii makes it easy for customers to manage their finances on the go.

One of the standout features of Simplii Financial is its no-fee daily banking options. Customers can enjoy unlimited transactions at no additional cost, which is a huge advantage for those who frequently use their accounts for everyday purchases or bill payments.

In addition to free banking services, Simplii also offers competitive interest rates on savings accounts and GICs (Guaranteed Investment Certificates). This means that customers can grow their money faster while still enjoying the convenience of online banking.

Another great benefit of choosing Simplii Financial is its access to a large network of ATMs across Canada. Customers can withdraw cash without any fees from over 3,400 CIBC ATMs nationwide.

Simplii Financial provides Canadians with a reliable and convenient online banking experience. Its commitment to offering no-fee daily banking and competitive interest rates make it a top choice for individuals looking for hassle-free financial management.

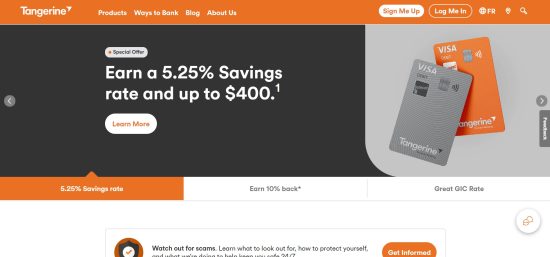

9. Tangerine

Tangerine is a popular online bank in Canada that offers a range of financial products and services. With its user-friendly interface and innovative features, it has gained a loyal customer base over the years.

One of the standout features of Tangerine is its no-fee banking options. This means that customers can enjoy basic banking services without having to worry about monthly fees eating into their savings. The absence of fees makes Tangerine an attractive choice for those who are looking to save money on banking costs.

Another great feature offered by Tangerine is its high-interest savings accounts. These accounts allow customers to earn competitive interest rates on their savings, helping them grow their wealth faster. This can be especially beneficial for individuals who want to build up an emergency fund or save for future goals.

In addition to traditional banking services, Tangerine also provides access to investment products such as mutual funds and GICs (Guaranteed Investment Certificates). This allows customers to diversify their portfolios and potentially earn higher returns on their investments.

Tangerine stands out among other online banks in Canada due to its commitment to providing affordable banking solutions with top-notch customer service. Whether you’re looking for everyday banking services or want to take your finances further with investments, Tangerine has got you covered!

10. Neo Financial

Neo Financial is an innovative online bank that has been making waves in Canada. With its user-friendly interface and wide range of features, it’s no wonder why this digital banking platform is gaining popularity among Canadians.

One of the standout features of Neo Financial is its cashback rewards program. Customers can earn cashback on their everyday purchases, allowing them to save money while they spend. Whether you’re shopping for groceries or treating yourself to a coffee, every purchase comes with the potential for cashback.

In addition to its rewards program, Neo Financial also offers competitive interest rates on savings accounts and flexible loan options. This means that customers can not only earn money through their spending but also make smart financial decisions when it comes to saving and borrowing.

Another great aspect of Neo Financial is its commitment to security and privacy. The platform utilizes advanced encryption technology to protect customer information, ensuring that your personal and financial data remains safe at all times.

Neo Financial provides an excellent digital banking experience for Canadians looking for convenience, rewards, and top-notch security. If you’re in search of an online bank that goes above and beyond traditional banking services, be sure to check out what Neo Financial has to offer!

Conclusion

Choosing the right online bank in Canada can make a significant difference in managing your finances efficiently and conveniently. With the convenience of digital banking, it is important to select a reputable institution that offers competitive rates, user-friendly platforms, and excellent customer service.

Whether you are looking for high-interest savings accounts, affordable mortgages, or seamless digital banking experiences, there is an option out there that will meet your requirements. Remember to do thorough research on each bank before making a decision; read reviews from other customers to get a sense of their experiences.

Finding the best online bank in Canada involves considering factors such as account types offered, fee structure, interest rates available, and overall customer experience. By choosing one of the top 10 online banks mentioned in this article.

FAQs – Top 10 Best Online Banks in Canada

1. What is the largest virtual bank in Canada?

One of Canada’s largest online banks, Motive Financial, is a part of Canadian Western Bank. In addition to chequing and savings accounts, GICs, TFSAs, and RRSPs are also provided by Motive Financial.

2. Can I open a bank account online without going to the bank Canada?

You have three options for opening a bank account: in-person, online, or over the phone. Your identity must be verified by suitable identification for the bank. If there are any alternative options to open an account with the bank, get in touch with them.

3. What is an disadvantage of online banking?

Online banking does offer a few possible drawbacks. These include the absence of in-person customer assistance, the inability to deposit cash, and the possibility of technological malfunctions or security breaches.

4. Is it better to open a bank account from a branch or online?

Compared to traditional banks, online banks often have lower fees and higher interest rates on deposit accounts.