Do you have credit card debt that’s been weighing on your mind? If so, a balance transfer credit card could be the solution for you. This type of credit card allows you to transfer your existing debt to a new account with a lower interest rate or even 0% interest for a limited time. Not only can this save you money in the long run, but it can also help simplify your finances by consolidating all of your debts into one manageable payment.

In this article, we’ll explore the top 10 best balance transfer credit cards in Canada and help you find the right one for your needs. So let’s get started!

What is a Balance Transfer Credit Card?

A balance transfer credit card is a type of credit card that allows you to move your existing debt from one or multiple cards onto a new account with a lower interest rate. This can be beneficial for those who are struggling to pay off high-interest debt and want to consolidate their payments into one manageable amount.

The process of transferring your balance involves applying for a new credit card, then requesting the transfer through either online banking or by phone. Once approved, the balance will be moved over to the new account, and you’ll begin making payments on it at the lower interest rate.

It’s important to note that most balance transfer credit cards come with an introductory period where there is little-to-no interest charged on transferred balances. However, this promotional offer typically lasts between six months and two years before reverting to a higher standard interest rate.

While using a balance transfer credit card can help alleviate some financial stress in terms of high-interest debt, it’s important not to use it as an excuse to continue overspending beyond your means.

How Does Balance Transfer Credit Cards Work?

Balance transfer credit cards work by allowing you to move your existing debt from one or multiple credit card accounts onto a new card with a lower interest rate. The idea is that by transferring your balance, you can reduce the amount of interest you pay on your outstanding balance and potentially save money in the long run.

To take advantage of this benefit, you’ll need to apply for a balance transfer credit card and provide details of the balances you want to transfer. If approved, the new card issuer will typically pay off your old debts for you and add them to your new account.

Most balance transfer credit cards offer an introductory promotional period during which time little or no interest is charged on transferred balances. This gives consumers some breathing room to make payments without accruing additional fees.

It’s important to note that after this promotional period ends, regular interest rates will apply – sometimes even higher than what was originally paid. It’s always best practice read all terms and conditions before applying for any financial product

Best Balance Transfer Credit Cards Canada – Top 10

1. BMO Preferred Rate MasterCard

BMO Preferred Rate MasterCard is a popular choice for those looking to transfer their credit card balances. The card offers a low-interest rate of 12.99% on purchases and balance transfers, making it an excellent option for those with high-interest debt.

One of the best features of the BMO Preferred Rate MasterCard is its extended grace period. Cardholders have up to 21 days after the statement date to pay off their balance before interest charges accrue. This can be especially helpful for those who need a little extra time to make payments each month.

Another great perk of this card is that it comes with no annual fee, which makes it an attractive option for budget-conscious individuals or those just starting on their financial journey.

Furthermore, new applicants can enjoy an introductory offer: 3 months at a 3.99% interest rate on balance transfers (a 1% fee applies). With its low rates and flexible payment options, the BMO Preferred Rate MasterCard is worth considering if you’re looking for a reliable balance transfer credit card in Canada.

2. Scotia Momentum No-Fee Visa card

The Scotia Momentum No-Fee Visa card is a popular choice for those looking to transfer their balance with no annual fees. This credit card offers cash-back rewards on everyday purchases, including groceries and gas.

One of the standout features of this card is its introductory offer of a 7.99% interest rate on balance transfers for the first six months. After that, the interest rate increases to a standard rate of 22.99%.

Another benefit of the Scotia Momentum No-Fee Visa card is its extensive insurance coverage, including travel accident insurance and rental car collision insurance.

With no annual fee and cashback rewards of up to 1%, this credit card can help you save money while paying off your balance transfer over time.

However, it’s important to note that to be eligible for this card, applicants must have an income of at least $12,000 per year and a good credit score.

If you’re looking for a balance transfer credit card with no annual fee and attractive cash-back rewards, the Scotia Momentum No-Fee Visa may be worth considering.

3. HSBC +Rewards Mastercard

The HSBC +Rewards Mastercard is one of the best balance transfer credit cards in Canada that offers a low-interest rate for balance transfers. It comes with no annual fee and provides users with 2 reward points per dollar spent on eligible dining or entertainment purchases.

One of the great features of this card is its flexibility, as it allows you to redeem your rewards points for travel, merchandise, gift cards, or even to pay down your account balance. Plus, if you spend $5,000 within the first year of opening an account, you can earn an additional 10,000 bonus rewards points.

Another benefit of using this card is its extended warranty coverage on most items purchased with the card. This means that if something goes wrong with your purchase within the designated time frame specified by HSBC (usually up to one year), you may be eligible for repair or replacement at no extra charge.

The HSBC +Rewards Mastercard is a great option for those looking to transfer high-interest balances and earn rewards on everyday purchases without having to pay an annual fee.

4. Tangerine Money-Back Credit Card

The Tangerine Money-Back Credit Card is a popular balance transfer credit card in Canada that offers a range of benefits to its users. One of the key features of this card is the cashback rewards program, which allows you to earn up to 2% cashback on your purchases.

Another great benefit of the Tangerine Money-Back Credit Card is that it has no annual fee, making it an affordable option for those who are looking for a good balance transfer credit card. Additionally, this card offers special promotions and bonuses from time to time, giving you even more opportunities to save money.

One thing that sets the Tangerine Money-Back Credit Card apart from other balance transfer cards is its flexibility when it comes to choosing your cashback categories. You can choose up to three categories where you will earn 2% cashback and one additional category where you will earn 0.5% cashback.

The Tangerine Money-Back Credit Card is an excellent choice if you’re looking for a flexible and affordable balance transfer credit card with great rewards and benefits.

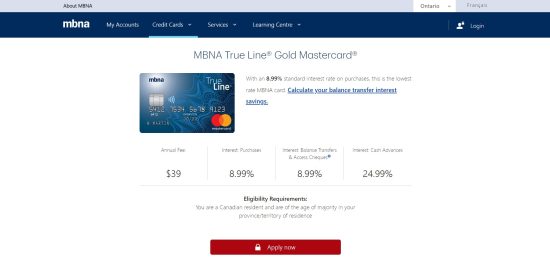

5. MBNA True Line Mastercard

The MBNA True Line Mastercard is a great option for those who want to transfer their balances from high-interest credit cards. This card comes with a low-interest rate of 12.99% on balance transfers and purchases, making it easier to pay off your debt.

One of the best things about this card is that there are no annual fees or balance transfer fees, which can save you money in the long run. Plus, MBNA offers additional perks such as extended warranty coverage and purchase assurance.

With the MBNA True Line Mastercard, you also have access to online banking services that allow you to manage your account from anywhere at any time. Additionally, this card has a mobile app that lets you track your spending and make payments on the go.

If you’re looking for an affordable way to consolidate your debts and simplify your finances, then the MBNA True Line Mastercard could be a great choice for you. Just remember to always read the terms and conditions carefully before applying for any credit card!

6. BMO CashBack Mastercard

The BMO CashBack Mastercard is one of the most popular balance transfer credit cards in Canada. This card offers a low-interest rate on balance transfers for the first nine months, making it an excellent choice if you want to pay off high-interest debt quickly.

In addition to its low-interest rate, this card also offers cashback rewards. You can earn 1% cash back on all purchases made with the card, and there’s no annual fee. Plus, you can get up to 5% cash back at select merchants through BMO’s online portal.

One of the best things about this card is that it’s easy to use. There are no complicated reward tiers or restrictions on when you can redeem your cashback rewards. Simply use your card as you normally would and watch your rewards pile up.

Another great feature of the BMO CashBack Mastercard is its fraud protection measures. You’ll be notified immediately if any suspicious activity is detected on your account, which will give you peace of mind while using this credit card.

If you’re looking for a straightforward and reliable balance transfer credit card with solid cashback rewards and fraud protection features, then consider applying for the BMO CashBack Mastercard today!

7. Desjardins Flexi Visa

If you’re looking for a balance transfer credit card that offers flexibility, the Desjardins Flexi Visa might be worth considering. With this card, you can choose your payment terms and adjust them as needed.

One of the standout features of the Desjardins Flexi Visa is its low promotional interest rate on balance transfers. You’ll get an introductory interest rate of 0% for six months on any balances transferred to the card. Plus, there’s no annual fee with this card.

Another benefit of the Desjardins Flexi Visa is its cash-back rewards program. You’ll earn 1% cash back on all purchases made with the card, which can help offset some of your other expenses.

If you’re looking for a balance transfer credit card that gives you control over your payments and offers solid rewards, take a closer look at the Desjardins Flexi Visa.

8. CIBC Select Visa Card

The CIBC Select Visa Card is a great choice for those looking to transfer their balance and save money on interest payments. With this card, you can enjoy a 0% introductory interest rate on balance transfers for the first 10 months. After that, the standard annual interest rate applies.

One of the best features of this card is its flexibility in terms of payment options. You can choose from weekly, bi-weekly or monthly payments depending on what works best for your financial situation.

The CIBC Select Visa Card also provides additional benefits such as Purchase Security and Extended Protection Insurance which covers eligible items against theft or damage for up to 90 days after purchase.

Another perk of this card is that it comes with no annual fee and offers cash-back rewards on all purchases made with the card.

If you are looking for a balance transfer credit card that not only helps you save money but also offers additional perks like cash-back rewards and flexible payment options, then the CIBC Select Visa* Card may be worth considering.

9. Alterna Savings Cash Back Visa

The Alterna Savings Cash Back Visa credit card is a great option for those looking to transfer their balance and earn cash back on their purchases. With no annual fee, this card offers 1% cash back on all eligible purchases with an additional 2% cash back on groceries.

One of the standout features of this card is its low-interest rate of only 8.99%, making it one of the best options for those carrying a balance. It also offers a balance transfer promotion where you can receive 0% interest for six months when transferring your balance from another credit card.

Additionally, the Alterna Savings Cash Back Visa comes equipped with travel insurance coverage, including emergency medical insurance and trip interruption/cancellation insurance. And if you’re looking to build or improve your credit score, this card reports to both Equifax and TransUnion.

The Alterna Savings Cash Back Visa is an excellent choice for those seeking a balance transfer credit card that also rewards them for their everyday spending while offering additional benefits such as travel insurance coverage at no extra cost.

10. BMO AIR MILES Mastercard

The BMO AIR MILES Mastercard is designed for frequent travellers who love to earn rewards. With this card, you can earn AIR MILES on your everyday purchases and redeem them for flights, hotel stays, car rentals, and more.

One of the best features of this credit card is its generous welcome offer. New cardholders can receive up to 800 bonus AIR MILES – enough for a one-way flight in some cases! Plus, there’s no annual fee for the first year.

In addition to earning 1 reward mile per $20 spent on regular purchases, you’ll also earn double miles when you shop at participating AIR MILES partners like Sobeys and Shell. This makes it easy to rack up points quickly without changing your spending habits too much.

Another perk of the BMO AIR MILES Mastercard is its travel insurance coverage. You’ll get out-of-province/country emergency medical insurance (up to $2 million), trip interruption/cancellation insurance (up to $2,500 per insured person), and rental car collision damage waiver coverage – all free of charge!

If you’re looking for a great balance transfer credit card with excellent rewards potential and travel benefits then the BMO AIR MILES Mastercard might be worth checking out.

Conclusion

To sum it up, balance transfer credit cards can be a useful tool for anyone looking to pay off their debt faster and save money on interest charges. By transferring your high-interest balances to one of the best balance transfer credit cards in Canada that we have discussed above, you can take advantage of lower interest rates and special promotional offers.

However, before applying for any card, make sure to read the terms and conditions carefully, including the fees associated with balance transfers. Also, keep in mind that while a balance transfer can help you pay off debt faster, it’s not a long-term solution for managing your finances.

Choosing the right balance transfer credit card depends on your individual needs and financial situation. We hope our list of the top 10 best balance transfer credit cards in Canada has helped you narrow down your options so that you can find the perfect fit for you and start saving money today!

FAQs on balance transfer credit cards Canada

1. Does balance transfer affect credit scores in Canada?

In some cases, a balance transfer could raise your credit score and enable you to pay less interest overall on your debt. But repeatedly getting new cards and transferring balances there will eventually damage your credit scores.

2. Can I transfer any balance to another credit card?

You can move a high-interest credit card amount (or perhaps several balances) to a new credit card with a reduced interest rate via a credit card balance transfer. For a certain period, several balance transfer cards offer a 0% introductory APR for balance transfers.

3. Why would a credit card balance transfer fail?

Your request for a balance transfer will be put on hold by the issuer until they can confirm how much can be transferred with respect to your credit limit. The issuer would probably deny the request if your credit limit is less than the sum you asked to transfer from another card.

4. Is it better to do balance transfer or pay off?

However, if you need months to pay off high-interest debt and have excellent enough credit to get approved for a card with a 0% introductory APR on balance transfers, a balance transfer is typically the best option. With one of these cards, you might cut your interest expenses dramatically and get a head start on balance payback.