Are you a small business owner in Canada looking for the best bank to handle your finances? With so many options available, it can be overwhelming to choose the right one. But don’t worry, we’ve got you covered! In this article, we’ll introduce you to the top 10 banks for small businesses in Canada. Whether you’re just starting or looking to switch from your current bank, read on to find out which one is the best fit for your needs.

From low fees and high-interest rates to personalized service and convenient online banking, these banks have everything you need as a small business owner. So let’s get started and find your perfect financial partner!

Benefits of Using a Bank for Small Businesses

Small businesses often operate on tight budgets and limited resources, which makes managing finances a crucial aspect of success. While some entrepreneurs may choose to handle their finances on their own, using a bank can bring numerous benefits.

- Having a dedicated business account keeps personal and business expenses separate. This not only simplifies accounting but also helps in tracking the financial health of the business

- Additionally, most banks offer specialized services for small businesses, such as credit lines, cash money loans and overdraft protection. These services help businesses to access capital quickly and efficiently when needed

- Another advantage is that banks provide secure online banking platforms with 24/7 access to accounts. This allows small business owners to check balances, transfer funds or make payments from anywhere at any time

- Using a bank can also boost credibility among clients and vendors by demonstrating financial stability and responsibility. It adds an extra layer of trustworthiness which can ultimately lead to increased sales and opportunities for growth

- Utilizing a bank for your small business offers convenience, security and professional legitimacy, which are essential elements in running a successful enterprise.

Best Bank for Small Business in Canada – Top 10

1. RBC Ultimate Business Account

RBC Ultimate Business Account is one of the best bank accounts for small businesses in Canada. This account offers a lot of benefits that can help entrepreneurs manage their finances effectively. The RBC Ultimate Business Account comes with unlimited transactions, which means you don’t have to worry about transaction fees eating into your profits.

This account also comes with a monthly fee waiver if you maintain a minimum balance, making it affordable and accessible for many business owners. Additionally, RBC’s online banking platform is user-friendly and easy to navigate, allowing business owners to view their account balances, monitor transactions, and transfer funds seamlessly.

Furthermore, the RBC Ultimate Business Account provides access to exclusive perks such as discounted merchant rates on payment processing services and special discounts on other financial products offered by RBC. With all these features combined into one package, it’s no wonder why this account is so popular among small business owners.

In conclusion, RBC Ultimate Business Account has proven itself as an excellent option for small businesses looking for reliable banking solutions. With its competitive pricing structure and extensive suite of tools tailored specifically towards entrepreneurs’ needs, it truly stands out as one of the best banks in Canada when considering where to store your company’s money.

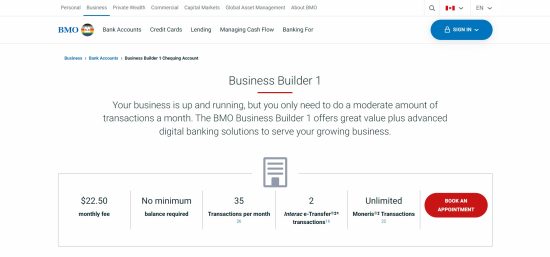

2. BMO Business Builder Account

BMO Business Builder Account is a popular option for small businesses in Canada. This account offers a range of features that cater to the needs of business owners. The account comes with unlimited transactions, which means you won’t have to worry about transaction fees cutting into your profits.

One of the best things about the BMO Business Builder Account is its flexibility. You can choose between different payment plans depending on your business needs. Whether you need a low monthly fee or prefer to pay per transaction, there’s an option for you.

Another great feature of this account is online banking and mobile banking access. With these tools, you can easily manage your finances from anywhere at any time. Plus, the BMO app allows you to deposit cheques using your phone so you don’t have to travel to the bank.

The BMO Business Builder Account also includes free electronic statements and alerts when funds are deposited or withdrawn from your account. These features help keep track of cash flow and ensure timely payments and deposits.

Suppose you’re looking for a flexible bank account with unlimited transactions plus online and mobile banking access. In that case, BMO Business Builder Account may be an excellent option for your small business needs in Canada!

3. Scotiabank Basic Business Account

The Scotiabank Basic Business Account is a great option for new small businesses looking for an affordable banking solution. With this account, you can access all the essential features and services that your business needs to manage its finances effectively.

One of the main benefits of the Scotiabank Basic Business Account is its low monthly fee. This makes it an excellent choice for entrepreneurs who are just starting and need to keep their expenses low. Additionally, there are also no transaction fees for electronic transactions, which can save your business even more money.

Another advantage of the Scotiabank Basic Business Account is that it comes with free online banking tools that make managing your accounts easy and convenient. You can view your account balances, transfer funds between accounts, pay bills online, and much more from anywhere at any time.

Furthermore, as a customer of Scotiabank’s basic business account package, you have access to personalized financial advice from knowledgeable professionals who understand your unique needs as a small business owner.

If you’re searching for simplicity in both cost and service then The Scotia Bank’s Basic Business Account might be worth considering!

4. ATB Unlimited Business Account

ATB Unlimited Business Account is a great option for small businesses looking to save on banking fees. This account offers unlimited transactions, which means that you won’t have to worry about paying extra fees every time you make a deposit or withdrawal.

One of the best features of this account is its flexibility. You can manage your finances in-person, online or through ATB’s mobile app. The account also offers overdraft protection and access to ATB’s business advisors who can provide guidance and support with financial decisions.

The ATB Unlimited Business Account also provides cash management services, allowing business owners to easily accept payments via debit card, credit card and e-transfers. Additionally, it comes with free cheque writing, free bill payments and no charge for deposits made at an ATM.

The ATB Unlimited Business Account is an excellent choice for small businesses seeking flexible banking options while saving money on transaction fees.

5. Tangerine Business Accounts

Tangerine Business Accounts are an excellent choice for small business owners who want to keep things simple. With no monthly account fees, free transactions, and unlimited deposits, this bank understands the needs of small businesses.

One of the most unique features of Tangerine Business Accounts is that they offer a cash-back credit card that can be linked directly to your account. This allows you to earn rewards on your everyday purchases while also managing your finances in one place.

Another great feature is their online banking platform which offers a user-friendly interface with 24/7 access to your accounts. You can easily view all transactions, pay bills and transfer funds at any time from anywhere.

Moreover, if you need support or have questions about using Tangerine Business Accounts, their customer service team is available via phone or email. They are known for being friendly and helpful whenever their customers need assistance.

If you’re looking for a straightforward banking option with no hidden fees or complicated requirements then Tangerine Business Accounts might just be the perfect fit for you!

6. Alterna Small Business eCheqking Account

Alterna Small Business eChequing Account is a great option for small businesses that want to keep their banking fees low. With no monthly account fee and 10 free transactions per month, this account can help you save money on your banking needs.

One of the main benefits of the Alterna Small Business eChequing Account is its online banking capabilities. You can access your account anytime, anywhere through Alterna’s online platform or mobile app. This feature allows you to manage your business finances with ease and convenience.

In addition, this account offers unlimited Interac e-Transfers at no extra cost. This means you can send money quickly and securely to any recipient in Canada without worrying about additional fees.

Another advantage of this account is that it comes with overdraft protection options, giving you peace of mind when unexpected expenses arise.

The Alterna Small Business eChequing Account is an excellent choice for small businesses looking for an affordable and convenient banking solution.

7. Manulife Business Advantage Account

Manulife Business Advantage Account is a great banking option for small businesses in Canada. This account offers unlimited transactions, with no additional fees for deposits or withdrawals. With this account, you can also enjoy free e-transfers and access to online banking.

One of the standout features of the Manulife Business Advantage Account is its tiered interest rates. The more money you have in your account, the higher interest rate you’ll receive. This can be a great way to earn extra income on your business’s funds.

Additionally, this account comes with overdraft protection options and the ability to link multiple accounts together. You can even order cheques for free through this account.

Manulife Business Advantage Account provides a comprehensive banking solution for small businesses in Canada. Whether you’re just starting or looking to switch banks, consider giving this account a try and see how it can benefit your business’s finances.

8. Wise Business Account

The Wise Business Account is a fairly new player in the small business banking landscape in Canada. It was designed to be a hassle-free option for entrepreneurs who want minimal fees and maximum flexibility.

One of the most unique features of this account is that it’s entirely digital, which means you can access your money anytime, anywhere using their app or website. This makes it especially appealing for those who run their businesses on the go.

Another perk of the Wise Business Account is that there are no hidden charges or transaction fees. You only pay what you see upfront, making it easy to budget and manage your finances.

Wise also integrates with popular accounting software like Xero and QuickBooks, so tracking your expenses has never been easier. Plus, they offer real-time exchange rates for international transactions at a lower cost than traditional banks.

The Wise Business Account may not have all the bells and whistles of some other accounts on this list, but its simplicity and transparency make it an attractive option for small business owners looking to keep things streamlined.

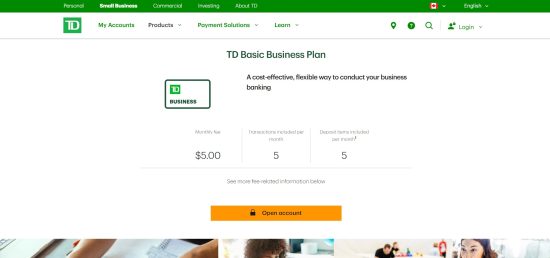

9. TD Basic Business Plan Account

The TD Basic Business Plan Account is a great option for small businesses looking for cost-effective banking solutions. With low monthly fees and no transaction limits, this account offers the flexibility that many entrepreneurs need to manage their finances effectively.

One of the key benefits of this account is its accessibility. TD Bank has branches all across Canada, making it easy for business owners to access their funds when they need them. Additionally, online banking services allow users to manage their accounts from anywhere at any time.

Another advantage of the TD Basic Business Plan Account is its comprehensive suite of tools and resources designed specifically for small businesses. From cash management solutions to merchant services, there are many features available that can help entrepreneurs streamline their operations.

While the TD Basic Business Plan Account may not be as feature-rich as some other options on the market, it provides an excellent balance between affordability and utility. For small business owners who want a reliable banking partner without breaking the bank themselves, this could be an ideal choice.

10. CIBC Basic Business Operating Account

CIBC Basic Business Operating Account is a popular option for small businesses in Canada. This account offers unlimited transactions and comes with an affordable monthly fee, making it a great option for those who are just starting.

One of the benefits of using this account is that it allows you to manage your finances online or on the go through CIBC’s mobile app. You can easily deposit cheques, transfer funds, and pay bills from anywhere at any time.

Another advantage of using CIBC’s Basic Business Operating Account is that they offer easy access to credit options such as business loans and lines of credit. This can be helpful when your business needs extra funding to grow or cover unexpected expenses.

Additionally, this account provides added security features such as fraud alerts and 24/7 monitoring to protect your business against fraudulent activity.

If you’re looking for an affordable yet reliable banking solution for your small business in Canada, CIBC’s Basic Business Operating Account is worth considering.

Tips to Choose the Right Bank for Your Business

Choosing the right bank for your small business is crucial to ensure that you have access to the financial services you need, such as loans and credit cards. Here are some tips to help you pick the best bank for your business needs.

Consider what kind of banking services your business requires. Do you need a simple checking account or more advanced accounting tools? Look into different banks and their products to see which ones best match your requirements.

Research the fees charged by each bank. Some banks may offer free accounts with no minimum balance required, while others may charge monthly fees or transaction fees. Make sure to choose a bank that fits within your budget.

Look at how accessible their customer service is. You want a bank with good customer support in case anything goes wrong with your account or if any issues need resolving.

Don’t forget about security measures when choosing a bank for your business needs. Ensure they have reliable fraud protection options and strong data encryption methods in place.

By following these tips, you can find the best bank for small businesses in Canada that suits all of your financial needs without breaking the bank!

Conclusion

Choosing the best bank for your small business in Canada is a crucial decision that can impact your financial success. As you have seen, there are several options available from traditional banks to online banks and credit unions. Each of them offers different features and benefits depending on your business needs.

It’s important to take the time to research and compare each option before making a final decision. Consider factors such as fees, banking services, customer support, convenience, and accessibility.

The right bank for your small business will help you manage your finances effectively while providing the necessary tools and resources to grow your enterprise. So don’t rush into it – do your due diligence and choose wisely!

FAQs on best bank for small business in Canada

1. What bank accounts does a small business need?

As soon as you start taking or spending money for business purposes, you should open a business bank account. Checking, savings, credit card, and merchant services accounts are a few examples of common company accounts.

2. Can I use my personal bank account for business in Canada?

In Canada, it is not illegal to use a personal bank account for business purposes. It is not advised, though, for several reasons.

- Firstly, using a personal account for business purposes could make it difficult to keep track of business expenses and income. This could lead to confusion during tax season or result in inaccurate financial records.

- Secondly, if your account is used for business purposes, it may become subject to seizure or garnishment in the event of any legal disputes or lawsuits involving your business.

- Therefore, it is recommended that you open a dedicated business bank account to manage your business finances and avoid potential complications or legal issues.

3. How much money should a small business have in the bank?

To maintain excellent financial status, your company should aim to set aside at least 10% of monthly profits or three to six months’ worth of expenses. In general, you should try to keep enough cash or liquid assets on hand to cover several months’ worth of costs.

4. What documents do I need to open a business bank account in Canada?

To open a business bank account in Canada, you typically need to provide several documents to the bank. These may include a valid government-issued ID, such as a passport or driver’s license, and proof of your business’s legal structure, such as a Certificate of Incorporation or Partnership Agreement. You may also be asked to provide proof of your business address, such as a utility bill or lease agreement, along with any relevant business licenses or permits.