As a business owner in Canada, you need to find the right credit card that offers rewards and perks for your daily expenses. It can be difficult to choose the best solution given the abundance of possibilities accessible. That’s why we’ve researched and compiled a list of the top 10 best credit cards for businesses in Canada.

From cashback to travel rewards, these cards offer great benefits and features that can help take your business to new heights. So without further ado, let’s dive into our comprehensive guide to finding the perfect credit card for your Canadian business!

Top 10 Best Credit Card for Business in Canada

1. BMO CashBack Business Mastercard

BMO CashBack Business Mastercard is one of the best credit cards for small business owners in Canada. This credit card offers a cashback program that rewards your business with 1.5% cashback on all purchases. It also has no annual fee, which makes it an excellent option for those who want to save money.

One great feature of this credit card is its easy-to-use online account management system, where you can easily access and monitor your transactions and rewards. You can also set up alerts to notify you when specific events occur, such as exceeding a certain spending limit or making a payment.

Another benefit of using the BMO CashBack Business Mastercard is that it provides purchase protection insurance and extended warranty coverage on eligible items purchased with the card. Plus, it comes with rental car insurance when renting from participating rental agencies worldwide.

Suppose you’re looking for a reliable credit card that offers cashback rewards without any annual fees while providing additional perks like purchase protection insurance and online account management tools. In that case, BMO CashBack Business Mastercard is definitely worth considering for your small business needs.

Website: https://www.bmo.com/main/business/credit-cards/bmo-cashback-no-fee-business-mastercard/

2. American Express Business Edge Card

The American Express Business Edge Card is an excellent option for small business owners who want to earn rewards for their everyday spending. With this card, you can earn up to 42,000 bonus points in your first year of membership.

One of the key benefits of this card is its flexible rewards program. You can earn points on various purchases, including office supplies, gas, and even advertising. Plus, there are no limits to how many points you can earn.

Another great American Express Business Edge Card feature is its travel insurance coverage. When you use your card to book travel arrangements for yourself or your employees, you’ll be covered by trip interruption/cancellation insurance and emergency medical insurance – giving you peace of mind when travelling for work.

In addition to these perks, the American Express Business Edge Card offers a low annual fee and a competitive interest rate in addition to these perks. It’s a solid choice for small businesses looking to maximize their rewards while keeping costs low.

Website: https://www.americanexpress.com/en-ca/credit-cards/edge-business/

3. Marriott Bonvoy Business American Express

The Marriott Bonvoy Business American Express credit card is an excellent choice for business owners who frequently travel and stay at Marriott hotels. With this card, you can earn up to 5X points on eligible purchases at participating Marriott Bonvoy hotels worldwide. Additionally, you’ll receive a free night prize each year following your account anniversary.

This card also offers a variety of other benefits, including complimentary Silver Elite status in the Marriott Bonvoy program and the ability to earn Gold Elite status after spending $30,000 on eligible purchases in a calendar year.

In addition to hotel perks, the Marriott Bonvoy Business American Express offers great rewards on everyday business purchases like office supplies and gas stations. You’ll earn 4X points per dollar spent in these categories and 2X points per dollar spent on all other eligible purchases.

Cardholders can also take advantage of purchase protection, extended warranty coverage, and access to exclusive events through Amex Offers. If you’re looking for a credit card that rewards you for frequent stays at Marriott hotels while still providing great benefits for everyday expenses, then the Marriott Bonvoy Business American Express could be right for your business needs.

Website: https://www.americanexpress.com/ca/en/credit-cards/marriott-bonvoy-business-card/

4. American Express Aeroplan Business Reserve Card

The American Express Aeroplan Business Reserve Card is a premium credit card option for businesses looking to earn rewards on their spending. This card comes with a hefty annual fee of $599 but also offers some impressive benefits.

One of the key features of this card is its ability to earn Aeroplan points quickly. Cardholders can earn 3x points on eligible Air Canada purchases, 2x points on eligible dining and food delivery purchases in Canada, and 1.5x points on all other eligible purchases.

In addition to earning rewards, this credit card also offers various travel perks such as airport lounge access, priority check-in and boarding with Air Canada flights, and complimentary first-checked bags for you and up to eight members travelling on the same reservation.

Cardholders can also benefit from purchase protection and extended warranty coverage for eligible items purchased with the card. If your business spends heavily on travel expenses or dining out frequently, then the American Express Aeroplan Business Reserve Card may be worth considering despite its high annual fee.

Website: https://www.americanexpress.com/ca/en/credit-cards/aeroplan-business-reserve-card/

5. CIBC Aventura Visa Card for Business Plus

CIBC Aventura Visa Card for Business Plus is a credit card designed specifically for business owners who want to earn rewards on their everyday purchases. With this card, you can earn 2 points per dollar spent on eligible travel and gas purchases and 1.5 points per dollar on all other purchases.

One of the best features of this card is that it offers comprehensive insurance coverage, including travel medical insurance and trip cancellation/interruption insurance. This means you can rest easy knowing you’re protected whenever you travel for business purposes.

Another great benefit of the CIBC Bank Aventura Visa Card for Business Plus is that it comes with a variety of perks, such as exclusive access to airport lounges, concierge services and discounts at select hotels worldwide. These benefits can help elevate your overall business travel experience while also saving money in the process.

If you’re looking for a credit card that provides excellent rewards and comprehensive insurance coverage while also offering various perks to enhance your business travels, then the CIBC Aventura Visa Card for Business Plus may be worth considering.

Website: https://www.cibc.com/en/business/credit-cards/aventura-plus-visa.html

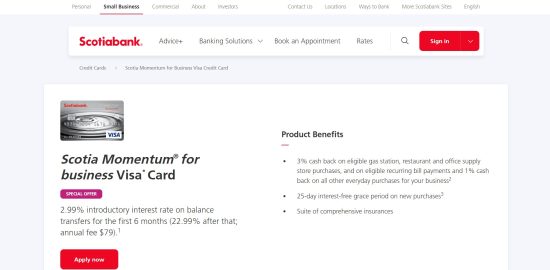

6. Scotia Momentum for Business Visa Card

The Scotia Momentum for Business Visa Card is a great option for businesses looking to earn cash back on their purchases. With this card, you can earn up to 3% cash back on eligible gas station, restaurant and office supply store purchases.

One of the key benefits of this Scotiabank Canada credit card is that it offers an introductory rate of 2.99% on balance transfers for the first six months. This can be a great way to save money if your business has existing credit card debt. In addition, the Scotia Momentum for Business Visa Card comes with comprehensive insurance coverage, including travel emergency medical insurance, rental car collision insurance and more.

Another advantage of this card is that additional cards have no annual fees, making it easy to manage employee spending while earning rewards. If your business frequently spends money at gas stations or restaurants and wants to take advantage of an attractive balance transfer promotion with a solid cashback rewards program, then consider applying for the Scotia Momentum for Business Visa Card.

Website: https://www.scotiabank.com/ca/en/small-business/business-banking/credit-cards/scotia-momentum-for-business-visa-credit-card.html

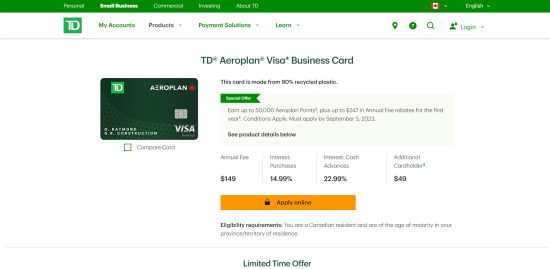

7. TD Aeroplan Visa Business Card

The TD Aeroplan Visa Business Card is an excellent option for business owners who frequently travel. This credit card allows you to earn Aeroplan points on all your purchases, which can be redeemed for flights and other travel rewards.

With the TD Aeroplan Visa Business Card, you can earn 1.5 miles per dollar spent on eligible gas, office supplies, and Air Canada purchases. You also get one mile per dollar spent on all other eligible purchases.

One of the perks of this card is that it comes with a welcome bonus offer where you can receive up to 20,000 bonus Aeroplan Miles when you make your first purchase with the card.

The TD Aeroplan Visa Business Card also has some added benefits, such as complimentary concierge service available 24/7 to help book flights, hotels and rental cars. It also offers insurance coverage like trip cancellation/interruption insurance and emergency medical insurance if needed while travelling outside of Canada.

The TD Trust Bank Credit Card could be a great choice for businesses looking to save money on frequent travel expenses while earning rewards at the same time.

Website: https://www.td.com/ca/en/business-banking/small-business/credit-cards/aeroplan-visa-business-card

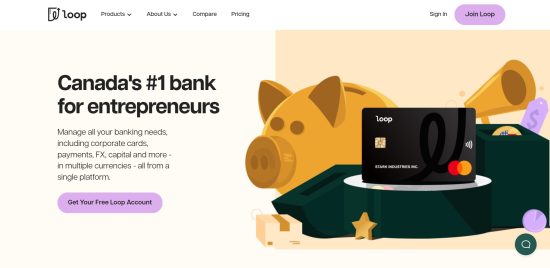

8. Loop Corporate Card

The Loop Corporate Card is a great option for businesses looking to streamline their expenses. It’s a virtual credit card that allows you to easily manage your company’s spending without the hassle of traditional corporate cards.

One of the biggest benefits of the Loop Corporate Card is its flexibility. You can set spending limits, restrict certain purchases, and even receive real-time alerts when employees make transactions. This gives you greater control over your company’s finances and helps prevent fraud.

Another advantage of using the Loop Corporate Card is that it integrates seamlessly with popular accounting software like QuickBooks and Xero. This makes tracking expenses, reconciling accounts, and generating detailed reports easy.

In addition, since the Loop Corporate Card isn’t tied to any specific bank or financial institution, there are no hidden fees or charges associated with using it. You pay an affordable monthly fee based on how many users you have.

If you’re looking for a simple yet effective way to manage your business expenses, then consider giving the Loop Corporate Card a try!

Website: https://www.getloop.ca/

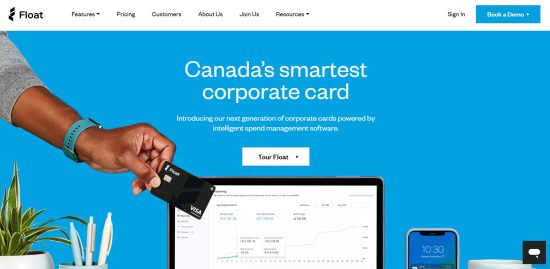

9. Float Card

Float Card is a credit card designed for small business owners who need to manage their cash flow efficiently. This card enables businesses to split expenses between employees, set limits on employee spending, and track all expenses in real time. With Float Card, businesses can have complete control over their finances without the hassle of manual tracking. The card has no annual fee and offers competitive interest rates with no hidden fees or charges.

One of the best features of Float Card is that it integrates seamlessly with accounting software like QuickBooks and Xero. This makes bookkeeping a breeze for small business owners who struggle to keep up with paperwork. Moreover, Float Card provides comprehensive reports to understand your business’s spending habits better. You get insights into where your money is going and how much you’re paying each vendor.

If you’re looking for a credit card that simplifies expense management for your small business while also providing transparency and control over spending, Float Card could be an excellent option.

Website: https://floatcard.com/

10. Desjardins Visa Business Credit Card

The Desjardins Visa Business Credit Card offers a range of benefits for small business owners in Canada. With no annual fee, cardholders can earn rewards points on all purchases made with the card. One standout feature is the ability to set individual credit limits for each employee who has access to the card. This allows business owners to maintain better control over their expenses and prevent overspending.

Additionally, there are multiple insurance options available with this card, including travel insurance and purchase protection. These add-ons can provide peace of mind for businesses that frequently travel or make large purchases.

Another perk is access to exclusive discounts through the Visa SavingsEdge program. This program offers savings on everything from office supplies to hotel stays and rental cars. The Desjardins Visa Business Credit Card is a solid option for small businesses looking for low-cost credit card with added perks and benefits.

Website: https://www.desjardins.com/ca/business/financing-credit/credit-cards/index.jsp

Conclusion

As we end our discussion on the Top 10 Best Credit Cards for Business in Canada, it’s important to remember that there is no one-size-fits-all solution for credit cards. Each business has unique needs and priorities, so it’s crucial to consider all options carefully before making a decision. We hope this article has helped guide your decision-making process toward finding the perfect credit card fit for your business.

FAQ – Top 10 Best Credit Card for Business in Canada

What is the best no fee credit card for small business in Canada?

As a small business owner in Canada, you may be looking for a credit card that offers rewards without any annual fees. Fortunately, there are numerous options available to you. One of the best no-fee credit cards for small businesses in Canada is the BMO CashBack Business Mastercard. This card offers 1.5% cash back on all purchases made with the card and has no annual fee.

Another great option is the American Express Business Edge Card which also comes with zero annual fees and provides up to 42,000 bonus points in your first year of use – enough value to cover an entire year’s worth of spending! For those who frequently travel for work purposes or want more flexible reward options, the Marriott Bonvoy Business American Express may be ideal. It offers free nights at participating hotels worldwide and features no annual fees.

While choosing the right credit card can depend on individual preferences and needs, these three cards stand out as top contenders for small businesses searching for a credit card with no annual fee but still providing valuable rewards.

Can I get a business credit card with a 625 credit score?

If you’re an entrepreneur looking to apply for a business credit card, your personal credit score will play a significant role in the approval process. Generally speaking, most issuers require a minimum credit score of 680 or above before they consider approving a business credit card application. However, that doesn’t mean getting approved with a lower score is impossible.

Some issuers may offer secured or low-limit options specifically designed for those with poor or fair credit scores. These cards often come with higher interest rates and fees but can be helpful in building up your business’s credit over time if used responsibly.

What is good credit for small business owners?

As a small business owner, having good credit is essential. Good credit essentially means that you have a history of responsible financial behaviour and are considered a low-risk borrower by lenders. But what exactly does it mean to have “good credit”?

Good credit typically involves having a high credit score above 680. This score considers factors such as payment history, the amount owed, length of credit history, and types of accounts held. Having good credit also means obtaining financing at favourable terms and interest rates. Lenders are more likely to offer loans with lower interest rates and better repayment terms to borrowers with good credit.

Another aspect of good credit for small business owners is access to larger lines of credit or higher loan amounts. With good credit, lenders may be more willing to extend higher limits on business lines of credit or approve larger loans for expansion purposes. Maintaining good personal and business financial habits can help ensure that your small business has strong finances, which will ultimately lead to greater growth potential in the long run.

What is the maximum credit limit in business card?

Choosing the right credit card for your business is crucial to keeping finances in order and maximizing rewards. Each of the top 10 best credit cards for businesses in Canada offers unique benefits that can cater to different types of businesses and spending habits.

When it comes to the maximum credit limit on a business card, this varies depending on various factors such as your credit score, income, and other financial information. Some issuers may offer higher limits than others based on their evaluation process. It’s important to review all options carefully before making a decision. Consider what type of rewards or cashback you’re looking for, annual fees versus no-fee options, interest rates, and any additional perks or benefits each card offers.