Are coins and cash too heavy for you to carry around? Do you wish to make payments for your goods in a safe, practical way? Look no further than the trusty debit card. Whether you’re buying groceries or treating yourself to a shopping spree, a debit card is an essential tool in today’s world. But how can you pick the finest option for your needs when there are so many available? Don’t worry – we’ve got you covered.

In this blog post, we’ll explore everything you need to know about debit cards and highlight the top 5 best ones available in Canada. Get ready to say goodbye to those bulky wallets and hello to seamless transactions with these fantastic debit cards!

What is a Debit Card?

Debit cards are payment cards that provide you direct access to your bank account’s funds. It works similarly to an ATM card but with the added convenience of being able to make purchases at merchants who accept it.

When you use your debit card for a transaction, the funds are immediately deducted from your account balance. This means you can only spend what you have in your account, making it a great tool for managing your finances and avoiding debt.

Most debit cards have security features such as PINs and fraud protection, so you can feel confident knowing your money is safe. Plus, they offer greater flexibility than cash or checks because they can be used online or in-person at millions of locations worldwide.

A debit card is essential for anyone looking for a convenient and secure way to manage their finances. With so many options out there today, it’s important to choose one that suits your needs best – which brings us to our next topic: how do you apply for a debit card?

The Benefits of Using a Debit Card

Debit cards are becoming increasingly popular as a convenient and safe payment option for consumers. Several benefits of using a debit card make it an attractive alternative to carrying cash or using credit cards.

- Using a debit card can help you stay within your budget because you can only spend the money that is available in your bank account. This makes it easier to manage your finances and avoid overspending. Additionally, since no interest is charged on purchases made with a debit card, you won’t accumulate debt like a credit card.

- Another benefit of using a debit card is the convenience factor. You can use your debit card to make purchases online or in-store without having to carry cash around with you. Many retailers also offer contactless payments, making transactions even quicker and more seamless.

- Many banks offer rewards programs for their customers who use their debit cards frequently. These rewards might include discounts at certain stores or cashback on qualifying purchases.

How is a Debit Card Differ from a Credit Card?

Debit and credit cards are two of Canada’s most widely used payment methods. However, there is a significant difference between these two types of plastic money.

- A debit card allows you to access funds from your bank account while a credit card offers you a line of credit that you can borrow against.

- Unlike credit cards, which allow users to make purchases on borrowed money and incur interest charges when they don’t pay off their balance in full each month, debit cards only allow transactions up to the amount available in your account. This means that you cannot spend more than what’s already in your bank account with debit cards.

- Another important factor is how these two types of cards affect your credit score. Credit card usage affects your overall debt utilization ratio whereas using a debit card does not impact it as it doesn’t involve borrowing money.

- In terms of rewards and perks, credit cards often offer cashback or other incentives for spending but are typically accompanied by annual fees or high-interest rates. On the other hand, many banks offer free Debit Cards without any associated fees.

- Both options have their advantages and disadvantages depending on individual needs but understanding these differences will help individuals choose the right one for them based on their financial situation and goals.

How to Apply for Debit Cards?

To apply for a debit card in Canada, you need to have an active bank account. This means finding a financial institution that suits your needs and opening an account with them. Many banks offer various types of accounts tailored to different lifestyles, so it’s important to do your research beforehand.

Once you’ve opened an account, the next step is requesting a debit card from your bank. Most banks will offer their customers a standard debit card as part of their banking package, but some may charge additional fees or offer premium cards with extra features.

To request the card, you’ll typically need to fill out an application form either online or at the bank branch. The application process usually involves providing personal information such as your name, address and identification documents like a passport or driver’s license.

After submitting the application form and any required documentation, it can take up to several business days for the bank to approve and issue your new debit card. Once you receive it in the mail or pick it up from the branch office, be sure to activate it before using it by following the instructions provided with your new debit card.

Applying for a debit card is fairly simple once you have completed all necessary steps and provided accurate information during registration!

Top 5 Best Debit Cards in Canada

1. PayPal Business Debit Mastercard

Introducing the PayPal Business Debit Mastercard, a fantastic option for those who frequently use their PayPal account for business transactions. This debit card allows you to access your funds directly from your PayPal balance, making it incredibly convenient for online entrepreneurs and freelancers alike.

One of the standout features of this card is its cashback rewards program. Users can earn 1% cash back on eligible purchases made with the card, an excellent incentive for those who use their debit cards often.

Another appealing aspect of the PayPal Business Debit Mastercard is that there are no monthly fees or annual charges associated with it. This makes it an ideal choice for small business owners looking to minimize expenses while maximizing benefits.

Additionally, since this debit card bears the Mastercard logo, it’s widely accepted at millions of locations worldwide. Whether you’re shopping online or in-store, you’ll enjoy seamless payments wherever Mastercard is accepted.

Account holders will appreciate real-time notifications and instant transaction alerts through email or text messages. These updates help users stay informed about their spending habits and maintain better control over their finances.

2. Empower Debit Card

Empower Debit Card is a popular choice for those who are looking for a reliable and secure debit card. What sets Empower apart from other debit cards in Canada is that it offers cashback rewards on everyday purchases, making it an attractive option for budget-conscious individuals.

One of the most notable benefits of using an Empower Debit Card is the ability to earn up to 1% cash back on eligible purchases. This can add up quickly over time and help you save money in the long run.

Another advantage of using an Empower Debit Card is its user-friendly mobile app, which allows you to easily track your spending and monitor your account activity. The app also helps you set savings goals and provides suggestions on how to reduce expenses.

In addition, with Empower’s automatic savings feature, users can effortlessly save money every time they make a purchase. This is especially useful for those who struggle with saving money or have difficulty sticking to a budget.

If you’re looking for a debit card that provides convenience and helps you keep more money in your pocket, consider applying for an Empower Debit Card today!

3. Axos Cash Back Checking Account

Are you looking for a debit card that gives you cash back on your purchases? Look no further than the Axos Cash Back Checking Account. This debit card offers up to 1% cash back on qualifying purchases, making it one of the best options available in Canada.

Its unique rewards program sets the Axos Cash Back Checking Account apart from other debit cards. With this account, you can earn cash back on everything from groceries to gas to dining out at restaurants. Plus, there are no limits on how much cash back you can earn each month.

In addition to its impressive rewards program, the Axos Cash Back Checking Account also comes with several other benefits. For example, no monthly maintenance fees and unlimited domestic ATM fee reimbursements exist.

To apply for an Axos Cash Back Checking Account, visit their website and fill out an application online. Once approved, your new debit card will be mailed directly to your home address.

If you’re searching for a high-rewarding debit card with great perks and minimal fees involved, give the Axos Cash Back Checking Account a try!

4. Discover Cashback Debit

Discover Cashback Debit is one of the best debit cards in Canada that offers a unique feature. It allows users to earn cashback on purchases made using their card. This is a great incentive for those who use their debit card frequently.

The cashback percentage varies depending on where you shop but can range from 1% to 5%. That’s money back in your pocket just for using your Discover Cashback Debit card!

Another benefit of this card is that no monthly fees or minimum balances are required. This makes it an affordable option for anyone looking to avoid unnecessary fees.

In addition, Discover Cashback Debit has no foreign transaction fees, making it ideal for those who travel frequently. You can use your card anywhere in the world without worrying about additional charges.

Discover Cashback Debit is a great option for anyone looking to earn rewards while using their debit card. Its lack of monthly fees and foreign transaction fees make it an excellent choice for frequent travellers as well.

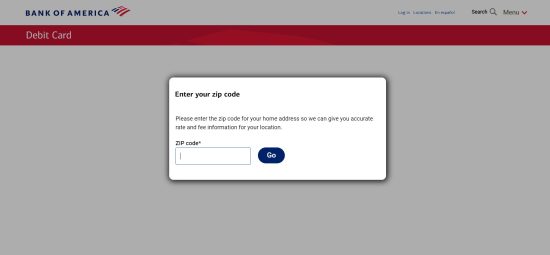

5. Bank of America Visa Debit Card

The Bank of America Visa Debit Card is popular among Canadians due to its convenience and security features. With this card, you can purchase at millions of locations worldwide without carrying cash or a chequebook.

One key benefit of the Bank of America Visa Debit Card is that it offers fraud protection. If your card is lost or stolen, you can immediately report it and receive a replacement. Additionally, every purchase made with the card is protected by Visa’s Zero Liability policy, which means you won’t be held responsible for unauthorized transactions.

Another advantage of the Bank of America Visa Debit Card is that it allows users to earn rewards points through the bank’s Preferred Rewards program. Depending on how much money you have in your account and what type of account you have, you could earn up to 5% cash back on eligible purchases.

If you’re looking for a reliable debit card with strong security features and potential rewards, the Bank of America Visa Debit Card may be a good option for you.

How to Choose the Right Debit Card?

When it comes to choosing the right debit card, there are a few important factors that you should consider.

- First and foremost, you’ll want to look for a card with low fees or no fees at all. This can include monthly maintenance fees, ATM withdrawal fees, and transaction fees.

- Another important factor is rewards programs. While not every debit card offers rewards, some do offer cash back or points for purchases made with the card. If this is something that interests you, make sure to compare different cards’ reward programs before making your decision.

- You’ll also want to consider the bank or financial institution issuing the card. Look for one with a good reputation and excellent customer service in case you have any issues or questions down the line.

- Think about what features are most important to you – such as mobile banking capabilities or fraud protection – and make sure that your chosen card offers them.

- By taking these factors into account when choosing your debit card, you can ensure that it meets your needs while also saving money and potentially earning rewards along the way!

Conclusion

After exploring the world of debit cards, we have learned about their benefits, how they differ from credit cards and how to apply for them. We have also discovered some of the best debit cards in Canada that offer great rewards and features. Choosing the right card depends on your personal financial needs and preferences.

Whether you are looking for cashback rewards or low fees, there is a debit card out there that suits you. Take your time to research and compare different options before making a decision.

Using a debit card can be an excellent way to manage your finances without overspending or accumulating debt. With so many fantastic choices available in Canada, it’s easy to find one that meets your needs while providing convenience and security wherever you go!