Are you tired of paying for purchases with cash or a traditional credit card? Have you considered using a points credit card to earn rewards on your everyday spending? With so many options available in Canada, finding the best one can be overwhelming. But don’t worry – we’ve done the research and compiled a list of the top 10 best points credit cards in Canada that will help you maximize your rewards and save money. So sit back, relax, and discover which card is perfect for you!

What Are Points Credit Cards?

Points credit cards are a type of credit card that rewards users with points for every dollar they spend. These points can then be redeemed for rewards such as travel, merchandise or cash back.

The waypoints earned vary from card to card, but typically users will earn one point per dollar spent on purchases. Some cards may offer bonus points in certain categories, such as dining or gas stations.

Points credit cards often have an annual fee and require a good credit score to qualify. However, the benefits of using these cards can outweigh the cost if used responsibly.

One key thing to keep in mind when using a points credit card is to pay off your balance in full each month. Otherwise, any interest charged on unpaid balances could negate the value of any rewards earned.

If used correctly and responsibly, points credit cards can be an excellent tool for earning valuable rewards while making everyday purchases.

How Do Points Credit Cards Work in Canada?

Points credit cards are a type of rewards card that allows you to earn points for every dollar spent on purchases. These points can then be redeemed for various rewards such as travel, merchandise, or cashback.

- In Canada, there are many different types of points credit cards available. Some cards offer a flat rate of points per dollar spent, while others offer bonus points in certain categories like groceries, gas, and dining.

- One thing to keep in mind when using a points credit card is that the value of each point may vary depending on how you redeem them. For example, some point systems will give you more value if you use your points towards travel instead of merchandise.

- It’s also important to note that some rewards programs have restrictions and blackout dates when it comes to redeeming your earned points. Make sure to read the fine print before signing up for any particular card or program.

- Utilizing a points credit card can be an effective way to earn rewards for everyday spending. Just make sure you understand how the system works so you can maximize your benefits!

How to Use a Points Credit Card?

Using a points credit card is an excellent way to earn rewards for your regular purchases. However, it’s important to know how to use it effectively to maximize the benefits.

- Always make a timely, full payment against your balance each month. Points cards often come with high-interest rates, so carrying a balance can quickly negate any rewards earned.

- Choose a card that aligns with your spending habits and offers increased earning potential on those purchases. For example, if you frequently travel or dine out, look for a card that offers bonus points for those categories.

- Be aware of any restrictions or blackout dates when redeeming your rewards. Some cards may limit where and when you can use your points or have expiration dates attached.

- Fourthly, consider pooling points from multiple cards or programs to increase their value when redeeming them for travel or other large purchases.

- Using a points credit card requires discipline and strategy but can ultimately lead to significant rewards over time.

The Best Points Credit Card in Canada – Top 10

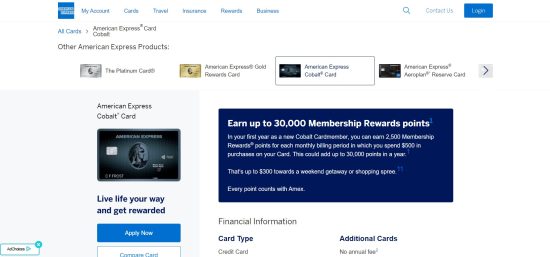

1. American Express Cobalt Card

The American Express Cobalt Card is a top contender for the best points credit card in Canada. With no annual fee for the first year, this card offers excellent value with flexible redemption options.

One of the unique features of this card is its rewards program, which allows you to earn 5x points on eligible eats and drinks, including groceries and food delivery services. You can also earn 2x points on travel purchases and gas stations, as well as 1x points on everything else.

In addition to earning points, several perks come with being an American Express Cobalt Cardholder. This includes access to exclusive events through Amex Invites and Front Of The Line ticket presales.

Another highlight of this card is its mobile app, which allows you to easily track your spending and redeem your points for a variety of rewards such as statement credits or travel bookings.

If you’re looking for a versatile and rewarding credit card that prioritizes dining out and entertainment experiences, then the American Express Cobalt Card may be the right choice for you.

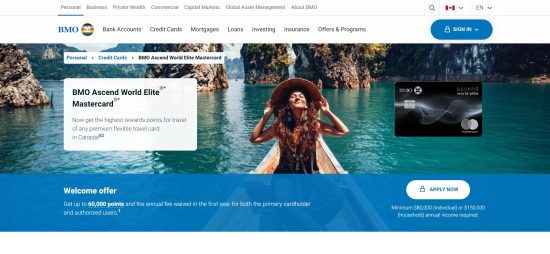

2. BMO World Elite Mastercard

BMO World Elite Mastercard is one of the best points credit cards in Canada that offers a wide range of benefits and rewards to its users. This card comes with an annual fee of $150, but it’s worth every penny for those who love to travel or enjoy dining out.

One of the most significant advantages of this card is that it provides users with 3 BMO Rewards points per dollar spent on travel, dining, and entertainment purchases. You can also earn two points per dollar spent on all other purchases.

Another great feature is that you get access to VIP airport lounges worldwide through Priority Pass membership. Along with that, you can receive up to $200 in annual travel credits when booking your trips using this card’s website.

The BMO World Elite Mastercard also offers comprehensive insurance coverage for everything from trip interruption and cancellation to emergency medical expenses while travelling abroad. Plus, there are additional perks like free roadside assistance and extended warranty protection on eligible items purchased with the card.

If you’re looking for a credit card packed with features and benefits tailored towards travellers and foodies alike, then the BMO World Elite Mastercard might be perfect for you!

3. National Bank World Elite Mastercard

The National Bank World Elite Mastercard is a great option for those looking to earn rewards on their everyday purchases. With this card, you can earn up to 2% cashback on all purchases, with no limit on how much you can earn.

In addition to the cashback rewards program, the National Bank World Elite Mastercard also offers travel insurance benefits such as trip cancellation and interruption insurance, baggage loss or delay insurance, and emergency medical coverage.

One of the standout features of this card is its VIP airport lounge access program. Cardholders have access to 6 free visits per year at participating lounges in Canada and the US. This feature alone could save frequent travellers hundreds of dollars each year.

Another benefit of this card is its concierge service which includes assistance with travel planning, restaurant reservations, and even finding tickets for events that may be sold out.

However, it’s worth noting that this card does come with an annual fee of $150 which may not be ideal for some individuals who are looking for a no-fee credit card option.

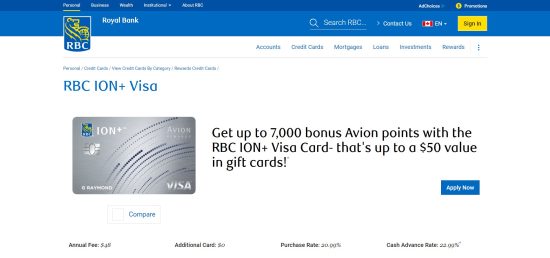

4. RBC ION+ Visa Credit Card

The RBC ION+ Visa Credit Card is a great choice for those who want to earn rewards on their everyday spending. With this card, you can earn up to 1.25% cash back on all purchases – there are no limits or restrictions on the amount of cash back you can earn.

One of the best things about this card is that it comes with comprehensive insurance coverage, including travel accident insurance and purchase protection. You’ll also get access to exclusive perks like VIP airport lounge access and discounted car rentals.

Another great feature of the RBC ION+ Visa Credit Card is that it offers a flexible redemption program. You can redeem your points for cash back, gift cards, merchandise, or even travel bookings – the choice is yours!

The RBC ION+ Visa Credit Card is an excellent option for anyone looking to earn rewards on everyday purchases while enjoying great perks and benefits.

5. HSBC World Elite Mastercard

HSBC World Elite Mastercard is one of the best points credit cards in Canada that offers a range of perks and rewards to its cardholders. With this card, you can earn up to 6x HSBC Rewards points on eligible travel purchases and up to 3x points on all other eligible purchases.

The annual fee for the HSBC World Elite Mastercard may seem steep at first glance, but it comes with an annual $100 travel enhancement credit which makes it more worthwhile. Additionally, new applicants can take advantage of a generous welcome bonus offer that includes up to 70,000 bonus points upon approval.

One unique feature of this card is its airport lounge access program known as LoungeKey where you can enjoy complimentary access to over 1,000 lounges worldwide – making your travels even more comfortable and luxurious.

Another remarkable perk that sets the HSBC World Elite Mastercard apart from others is its extensive insurance coverage including out-of-province emergency medical insurance for trips up to 31 days long. The card also provides trip interruption/cancellation insurance and rental car collision/loss damage waiver coverage.

If you are someone who values luxury travel benefits along with comprehensive insurance coverage and exceptional reward programs then the HSBC World Elite Mastercard might be just what you need!

6. Scotiabank Gold American Express Card

The Scotiabank Gold American Express Card is an excellent choice for anyone who loves to travel or shop. This credit card comes with a strong rewards program that allows you to earn points on every purchase, which can be redeemed for travel, merchandise, and more.

One of the most significant benefits of the Scotiabank Gold American Express Card is its generous welcome bonus. When you sign up for this credit card and spend $1,000 in your first three months, you’ll receive 25,000 Scotia Rewards points – that’s worth $250 towards travel purchases!

Another great feature of this credit card is its flexible redemption options. You can use your points to book flights, hotels or vacation packages through Scotia Rewards Travel Service or transfer them directly into frequent flyer programs like Aeroplan®, AAdvantage® or Avios®.

Moreover, this credit card also provides comprehensive insurance coverage such as emergency medical insurance (up to $1 million), trip interruption/cancellation insurance (up to $2,500 per person), car rental collision/loss damage waiver coverage and flight delay/trip interruption insurance.

If you’re looking for a versatile rewards program that offers flexibility when it comes time to redeem your earnings and extensive insurance benefits; then look no further than the Scotiabank Gold American Express Card!

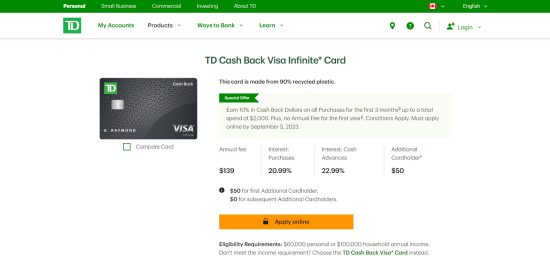

7. TD Cash Back Visa Infinite Card

The TD Cash Back Visa Infinite Card is a great option for those looking to earn cash back on their everyday purchases. With this card, you can earn up to 3% cash back on eligible grocery and gas purchases and recurring bill payments.

In addition to earning cash back, the TD Cash Back Visa Infinite Card offers additional perks such as travel insurance coverage and access to exclusive events. Plus, new cardholders can take advantage of a welcome bonus of up to $300 in cash back.

To maximize your rewards with this card, it’s important to use it consistently for your everyday spending. By doing so, you’ll be able to rack up cash back quickly and easily.

Suppose you’re looking for a straightforward rewards credit card that offers generous cash-back rates on essential purchases like groceries and gas. The TD Cash Back Visa Infinite Card is worth considering in that case.

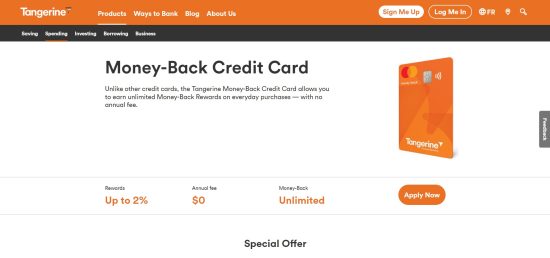

8. Tangerine Money-Back Credit Card

Tangerine Money-Back Credit Card is one of the best points credit cards in Canada that offers great rewards to its users. With this card, you can earn cashback on all your purchases without any limits or restrictions. The card also has no annual fee and comes with a low-interest rate.

One of the key benefits of the Tangerine Money-Back Credit Card is its flexibility. You can choose up to three categories in which you want to earn 2% cashback while earning 0.5% cashback on all other purchases. This customization feature makes it an ideal option for those who have specific spending habits.

Moreover, Tangerine’s mobile app allows easy account management and timely notifications about your transactions and rewards earned.

In addition, this credit card offers various insurance coverages, such as travel medical insurance and rental car insurance, at no extra cost when used for eligible expenses.

If you are looking for a flexible and rewarding credit card with no annual fee, then the Tangerine Money-Back Credit Card could be a perfect fit for you!

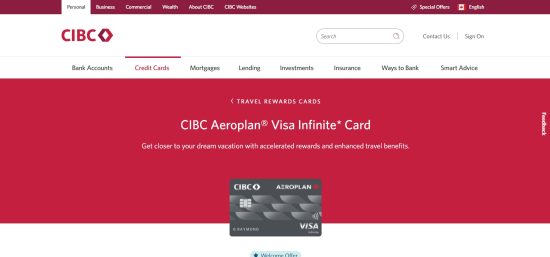

9. CIBC Aeroplan Visa Infinite Card

The CIBC Aeroplan Visa Infinite Card is one of the best points credit cards in Canada, especially for frequent flyers. This card offers a sign-up bonus of 20,000 Aeroplan Miles and an additional 10,000 miles if you spend $3,000 within the first four months of opening the account.

One great feature of this card is that it allows you to earn miles on all your purchases- from groceries to gas. You can earn 1.5 miles for every dollar spent on eligible gas, grocery and drugstore purchases and one mile per dollar spent on everything else.

This card also comes with other travel benefits such as priority check-in at airports across Canada, access to VIP airport lounges worldwide through Priority Pass membership and travel insurance coverage up to $5 million.

As an added perk, this card has no annual fee for the first year – a great way to try it out before committing long-term. If you’re looking for a points credit card that rewards your travels while offering generous perks along the way then be sure not to miss out on considering CIBC Aeroplan Visa Infinite Card!

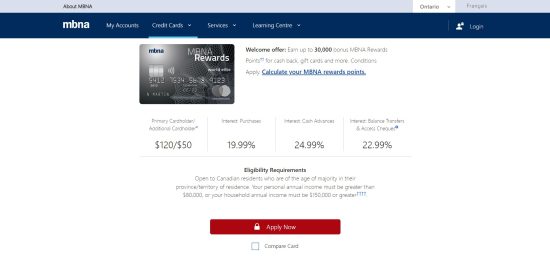

10. MBNA Rewards World Elite Mastercard

The MBNA Rewards World Elite Mastercard is a popular choice for those looking to earn rewards on their credit card spend. With this card, you can earn 2 points per dollar spent on all purchases, with no limit to how many points you can earn. Plus, there’s a welcome bonus of up to 30,000 points when you make your first purchase.

One great feature of the MBNA Rewards World Elite Mastercard is that it allows you to redeem your points for travel or cash back at the same rate – 100 points equals $1 in value. This means that you have flexibility in how you choose to use your rewards.

Another benefit of this card is that it comes with comprehensive travel insurance coverage, including trip cancellation and interruption insurance and emergency medical coverage. This can give peace of mind when travelling abroad.

The MBNA Rewards World Elite Mastercard offers strong rewards earning potential and flexible redemption options, making it a top contender among Canadian credit cards.

Conclusion

To sum up, choosing the best credit card points in Canada can be daunting. But with our list of top 10 cards, you can make an informed decision based on your spending habits and reward preferences.

Remember to always read the fine print and understand all the fees associated with each card before making a final decision. Also, keep track of your spending and pay off your balance in full every month to avoid interest charges.

Whether you’re looking for travel rewards, cashback or other perks, there’s sure to be a points credit card that suits your needs. So go ahead and apply for one today – start earning rewards on every purchase!