Are you looking for the best Visa credit cards in Canada? With so many options available, choosing the right one can be overwhelming. That’s why we’ve done the research for you and narrowed down the top 9 best Visa credit cards in Canada for 2023. Whether you’re a frequent traveller, cashback enthusiast, or looking to earn rewards on everyday purchases, there’s a card on this list that will suit your needs. So sit back, relax and let us guide you through our handpicked selection of the best Visa credit cards in Canada!

Best Visa Credit Cards in Canada 2023 – Top 9

1. RBC Avion Visa Infinite

RBC Avion Visa Infinite is one of the most popular credit cards in Canada. It offers a range of benefits to its users, including flexible rewards, travel insurance and premium perks. With this card, you can earn RBC Rewards points for every dollar spent on eligible purchases.

One of the standout features of the RBC Avion Visa Infinite is its flexibility when it comes to redeeming rewards points. You can use your points to book flights and hotels through RBC’s travel booking service or transfer them to other loyalty programs such as British Airways Executive Club or American Airlines AAdvantage.

Another great benefit is the comprehensive travel insurance coverage that comes with this card. This includes trip cancellation and interruption insurance, emergency medical coverage for up to 15 days per trip outside your home province or territory, flight delay insurance and more.

Cardholders also enjoy access to exclusive experiences and privileges through RBC’s partners such as luxury hotel upgrades, VIP airport lounge access and more.

If you’re looking for a versatile credit card that offers both reward-earning potential and robust travel benefits, the RBC Avion Visa Infinite could be an excellent choice for you.

2. BMO Eclipse Visa Infinite

BMO Eclipse Visa Infinite is an excellent credit card that offers a wide range of benefits to its users. One of the most significant advantages of this card is its generous rewards program, which allows you to earn BMO Rewards points for every dollar spent on eligible purchases.

With the BMO Eclipse Visa Infinite, you can enjoy a welcome bonus of up to 40,000 BMO Rewards points. You also get access to airport lounges worldwide through Priority Pass and other travel perks like travel medical insurance and trip cancellation/interruption insurance.

The card’s annual fee may seem high at first glance; however, it is easily offset by the many benefits that come with using this card. Furthermore, there are no foreign transaction fees when using your card abroad, making it an ideal choice for frequent travellers or those who shop online regularly from international retailers.

If you’re looking for a credit card that offers flexibility in redeeming rewards and provides fantastic travel perks while avoiding foreign transaction fees – then look no further than the BMO Eclipse Visa Infinite!

3. Scotia Momentum Visa Infinite Card

The Scotia Momentum Visa Infinite Card is a popular option among Canadians who want to earn cash back on their purchases. With this card, you can earn up to 4% cash back on eligible gas and grocery purchases, as well as recurring bill payments.

In addition to the generous rewards program, the Scotia Momentum Visa Infinite Card offers travel insurance benefits such as trip interruption/cancellation insurance and rental car collision/loss damage insurance.

Cardholders can also take advantage of concierge services that can help with everything from restaurant reservations to travel arrangements.

One notable feature of this card is its flexible redemption options. You can redeem your cash back for statement credits or deposit it directly into your bank account. Plus, there’s no limit on how much cash back you can earn – making it a great choice for big spenders.

The Scotia Momentum Visa Infinite Card is an excellent choice for those looking for a versatile credit card with strong rewards programs and useful additional perks.

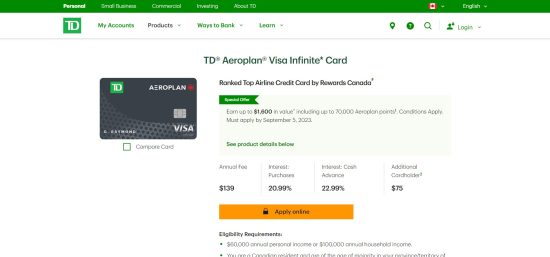

4. TD Aeroplan Visa Infinite

The TD Aeroplan Visa Infinite is a popular credit card in Canada for those who love to travel and want to earn rewards. This card comes with an impressive welcome bonus of 20,000 Aeroplan points – enough for a round-trip ticket within North America.

One of the standout features of this card is its earning potential. Cardholders can earn up to 1.5 Aeroplan miles per dollar spent on eligible purchases, which can add up quickly if you use your credit card frequently.

Another benefit of TD Aeroplan Visa Infinite is its travel insurance coverage. This includes emergency medical insurance, trip cancellation and interruption insurance, as well as baggage loss and delayed flight coverage.

Additionally, this card offers exclusive benefits such as access to priority check-in at select airports when flying with Air Canada and a complimentary first-checked bag on flights operated by Air Canada.

The TD Aeroplan Visa Infinite is a great choice for frequent travellers who want to earn rewards while enjoying unique perks and benefits along the way.

5. Rogers World Elite Mastercard

The Rogers World Elite Mastercard is a great option for frequent travellers who want to earn rewards and save money on foreign transactions. With this card, you can get 1.75 percent cash back on all purchases made in Canadian money and 4 percent cash back on international transactions.

One of the biggest advantages of the Rogers World Elite Mastercard is its lack of annual fees. This means that you can enjoy all the benefits of this credit card without having to pay for it every year.

Another advantage is the fact that it offers complimentary travel insurance coverage, including out-of-province emergency medical insurance, trip cancellation/interruption insurance, and rental car collision/damage waiver coverage.

Additionally, if you use your Rogers World Elite Mastercard to purchase a flight or vacation package through any travel agency or tour operator charged directly to your credit card statement will be credited by applying earned rewards towards eligible travel purchases

If you’re looking for a credit card with excellent rewards options and no annual fee while enjoying many other perks like exclusive access to events then The Rogers World Elite Mastercard might be an ideal choice.

6. CIBC Aventura Gold Visa Card

If you’re someone who loves to travel and wants a credit card that can give you some great rewards, the CIBC Aventura Gold Visa Card might just be the perfect fit for you. This card is known for its amazing travel benefits that make it stand out from other cards in Canada.

One of the best things about this card is that it comes with an impressive signup bonus. You can earn up to 20,000 Aventura points when you use your card for the first time. These points can be redeemed for flights, hotels, car rentals or even vacation packages.

Another great feature of this card is its flexible redemption options. You can redeem your points towards any airline ticket without having to worry about blackout dates or seat restrictions. Plus, there are no expiration dates on these points so they’ll always be available when you need them.

The CIBC Aventura Gold Visa Card also offers insurance coverage on everything from trip cancellations and interruptions to lost luggage and hotel/motel burglaries while travelling outside of Canada. So if anything goes wrong during your travels, you won’t have to worry as much knowing that your credit card has got your back.

If you’re looking for a credit card that will allow you to travel more easily and comfortably while earning some fantastic rewards along the way, then definitely consider adding the CIBC Aventura Gold Visa Card to your wallet!

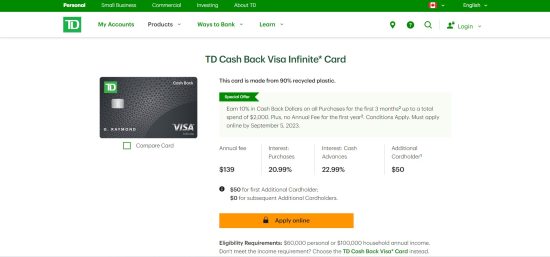

7. TD Cash Back Visa Infinite

The TD Cash Back Visa Infinite credit card is an excellent choice for Canadians who want to earn cash back on their everyday purchases. With this card, you can earn up to 3% cash back on eligible grocery and gas purchases, as well as recurring bill payments.

One of the standout features of this card is its flexibility when it comes to redeeming your cash-back rewards. You can choose to apply your rewards towards your account balance or have them deposited directly into a TD bank account.

Another great perk of the TD Cash Back Visa Infinite is that it offers extensive insurance coverage, including travel medical insurance and trip cancellation/interruption insurance. This makes it an ideal option for frequent travellers who want peace of mind while they’re away from home.

In addition, this card also comes with a range of additional benefits such as exclusive access to events and experiences through Visa Infinite Concierge service and discounts at select retailers across Canada.

If you’re looking for a versatile cash-back credit card with comprehensive insurance coverage and added perks, the TD Cash Back Visa Infinite could be an excellent choice for you.

8. Home Trust Preferred Visa Card

The Home Trust Preferred Visa Card is a great option for those looking for a no-fee credit card that still offers rewards. This card earns 1% cash back on all purchases, which can be redeemed as statement credits once the cash back balance reaches $25.

One of the standout features of this card is its lack of foreign transaction fees. Many other credit cards charge up to 2.5% in foreign transaction fees, making them less desirable for international travel or online shopping from international retailers.

In addition to its rewards and lack of foreign transaction fees, the Home Trust Preferred Visa Card also comes with basic insurance coverage including car rental collision/loss damage waiver and purchase security and extended warranty protection.

However, it’s important to note that while this card doesn’t have an annual fee or foreign transaction fees, it does have a high-interest rate. As such, it’s recommended that users pay off their balances in full each month to avoid accruing interest charges.

If you’re looking for a no-fee credit card with solid rewards and benefits for travel and online shopping without foreign transaction costs but are prepared to pay off your balance each month diligently then Home Trust Preferred Visa Card would be an excellent choice.

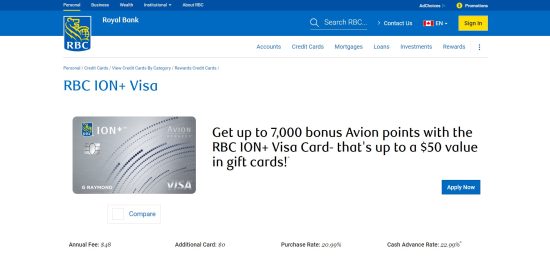

9. RBC ION+ Visa Card

The RBC ION+ Visa Card is one of the best credit cards in Canada, particularly for those who frequently travel outside the country. This card offers a range of benefits, including travel insurance coverage and no foreign transaction fees.

One of the most attractive features of this credit card is its extensive rewards program. Users can earn points on every purchase they make with their card, which can be redeemed for travel expenses such as flights or hotel stays.

In addition to these perks, the RBC ION+ Visa Card also comes with exclusive access to airport lounges around the world through Priority Pass membership. This means that users can relax in comfort while waiting for their next flight without having to pay extra fees.

Another notable feature of this credit card is its security measures. The RBC ION+ Visa Card uses advanced encryption technology to protect user data and prevent fraud. Additionally, users are protected by zero-liability protection against unauthorized charges made on their accounts.

If you’re someone who values both convenience and security when it comes to your credit card usage while travelling abroad, then the RBC ION+ Visa Card could be an excellent choice for you!

Conclusion

To sum up, choosing the best Visa credit card in Canada can be a daunting task. However, with this comprehensive guide on the top 9 best Visa credit cards in Canada for 2023, you are sure to make an informed decision.

No matter what your spending and reward preferences are, there is a Visa credit card that suits your needs perfectly. From travel rewards to cashback and low-interest rates, these Visa credit cards offer unbeatable benefits and features.

Before applying for any of these top-rated Visa credit cards in Canada, make sure to read through their terms and conditions carefully. This will help you understand all the fees associated with using each card as well as their respective interest rates.

With proper research and careful consideration of your financial situation and spending habits, you’ll find the perfect Visa credit card that offers maximum value while helping you achieve your long-term financial goals.