Are you tired of paying high-interest rates on your credit card balances? It’s time to consider low-interest credit cards! With a low-interest rate, you can keep your interest costs down and pay off your balance faster. But what exactly are low-interest credit cards and how do they work? In this blog post, we’ll explore all the benefits of having a low-interest credit card in Canada. We’ll also give you our top picks for the best low-interest credit cards available in Canada right now! So let’s dive in and save some money together!

What is a Low-interest Credit Card?

A low-interest credit card is a type of credit card that comes with a lower annual percentage rate (APR) than the average credit card. The APR is the amount of interest charged on the outstanding balance, expressed as an annual percentage. Low-interest credit cards typically have APRs ranging from 8% to 15%, while traditional credit cards can come with rates as high as 25% or more.

The main benefit of having a low-interest credit card is that it can save you money in interest charges over time. If you carry a balance on your credit card each month, even a small difference in APR can make a big impact on your overall debt and repayment timeline.

It’s important to note that low interest doesn’t necessarily mean no interest, so it’s still crucial to pay off your balances in full and on time each month to avoid any additional fees.

Having a low-interest credit card can be an excellent financial tool for those who are looking to keep their costs down and pay off their debts faster.

How Do Low-interest Credit Cards Work?

Low-interest credit cards work like any other credit card but with a lower annual percentage rate (APR). The APR is the interest charged on outstanding balances on your credit card. With a low-interest credit card, you will pay less interest charges over time compared to a high-interest credit card.

- When you use your low-interest credit card to make purchases, you still have to make at least the minimum monthly payment before the due date. If you carry a balance and don’t pay it off in full each month, then the remaining balance accrues interest charges at the stated APR until it’s paid off.

- Some low-interest cards have an introductory period where they offer 0% or very low rates for new customers. This can be beneficial if you need to make a large purchase and want some time to pay it off without accruing too much interest.

- It’s important to note that most low-interest cards may come with an annual fee or other limitations such as no rewards program. However, these fees might be offset by paying less in overall interest costs over time.

- Using a low-interest credit card can help keep costs down while still allowing for everyday spending needs.

The Benefits of a Low-interest Credit Card

Using a low-interest credit card can offer a range of benefits for Canadians who want to keep their interest costs down.

- One major advantage is that it can help you avoid costly fees associated with higher-interest cards.

- By choosing a low-interest credit card, you may be able to save money on interest payments over time. This means that more of your monthly payment will go towards paying off the principal balance, rather than just covering the cost of borrowing.

- Another benefit of using a low-interest credit card is that it can provide greater flexibility in managing your finances. With lower rates, you may be able to pay off larger balances more quickly or take advantage of promotional offers without worrying about high APRs later on.

- Additionally, many low-interest credit cards come with valuable rewards programs and other perks such as cashback rewards or travel rewards points. These incentives can make using your card even more beneficial when used responsibly.

By selecting the right low-interest credit card for your needs and financial goals, you could enjoy significant savings on fees and finance charges while also enjoying added benefits like reward points or cash-back offers.

How to Apply for a Low-Interest Card in Canada?

If you’re interested in applying for a low-interest credit card in Canada, there are a few things you should know before starting your search. It’s important to understand that not all low-interest cards are created equal – some may come with additional perks or benefits while others may have stricter eligibility requirements.

- To begin your search for the perfect low-interest credit card, start by researching different options online. Look at various banks and financial institutions to get an idea of what each one offers.

- Once you’ve narrowed down your choices, read through the terms and conditions carefully to ensure that you meet the eligibility criteria. This may include having a certain income level or credit score.

- When you’re ready to apply for a low-interest credit card, most providers will allow you to do so online or over the phone. You’ll typically be asked to provide personal information such as your name, address, and social insurance number as well as details about your employment status and income.

- It’s important to note that when applying for any type of credit card in Canada, it’s always best practice to only apply for one at a time – multiple applications can negatively impact your credit score.

By following these steps and doing thorough research beforehand, you can successfully apply for a low-interest credit card in Canada that meets both your financial needs and lifestyle preferences.

Top 5 Low-Interest Credit Cards in Canada

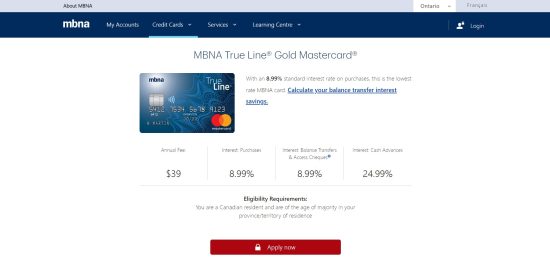

1. MBNA True Line Gold Mastercard

MBNA True Line Gold Mastercard is a great option to consider if you’re in search of a low-interest credit card in Canada. This card offers an incredibly low annual interest rate of only 8.99%, which is lower than most other cards on the market.

With MBNA True Line Gold Mastercard, you can enjoy peace of mind knowing that your credit card debt won’t spiral out of control due to high-interest rates. Additionally, this card has no annual fee, so you don’t have to worry about paying any extra fees just for owning it.

One added benefit of this particular card is its cash advance feature, which allows users to withdraw money from ATMs quickly and easily when needed. Although keep in mind that there may be some associated fees with using this feature.

MBNA True Line Gold Mastercard is an excellent option for those looking for a reliable low-interest credit card with minimal additional costs.

2. National Bank Syncro Mastercard

National Bank Syncro Mastercard is one of the top low-interest credit cards in Canada. With an annual fee of $35, cardholders can enjoy a fixed interest rate of 9.90% on purchases and balance transfers.

One great feature of this card is that it offers purchase protection and extended warranty coverage on eligible items purchased with the card. Cardholders also have access to exclusive dining experiences, travel deals, and entertainment events through National Bank’s rewards program.

Another benefit of the National Bank Syncro Mastercard is its cash advance option at a reasonable rate compared to other credit cards. Additionally, with the availability of mobile payment options like Apple Pay, Google Pay or Samsung Pay makes purchasing seamless for users.

The application process for this card is straightforward and can be done online within minutes. Applicants need to meet certain requirements such as being a Canadian resident over 18 years old and having a minimum annual income as per bank guidelines.

If you are looking for a low-interest credit card that offers excellent benefits while keeping your costs down in Canada – National Bank Syncro Mastercard might just be what you need.

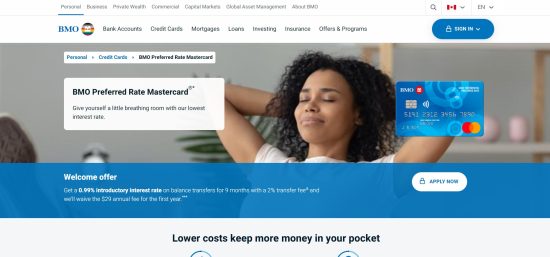

3. BMO Preferred Rate Mastercard

The BMO Preferred Rate Mastercard is an excellent option for those who want to keep their interest costs down without sacrificing rewards. This card offers a low-interest rate on purchases and balance transfers, making it easier to pay off your debt faster.

With the BMO Preferred Rate Mastercard, you can enjoy a 3.99% introductory interest rate on balance transfers for nine months, which is one of the longest promotional periods in Canada. After that period ends, your interest rate will be 12.99%, which is still relatively low compared to other credit cards.

This card also comes with basic travel insurance coverage and purchase protection, so you can feel secure while using it for everyday purchases or when travelling abroad.

One of the unique benefits of this card is that it offers free supplementary cards for family members at no additional cost. This makes it easier to earn rewards faster by pooling all spending onto one account.

If you are looking for a low-interest credit card that also provides some added perks and benefits, consider applying for the BMO Preferred Rate Mastercard today!

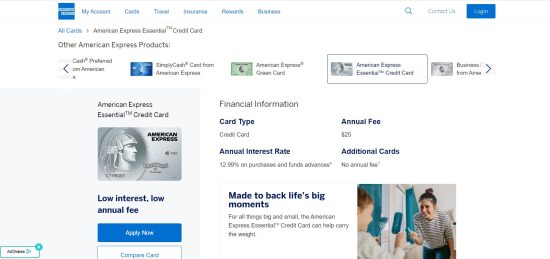

4. American Express Essential Card

The American Express Essential Card is a low-interest credit card that offers many benefits for its users. One of the most attractive features of this card is the fact that it has no annual fee, making it an affordable option for those who are looking to keep their costs down.

Another benefit of the American Express Essential Card is its low-interest rate, which can help you save money on interest charges if you carry a balance from month to month. Additionally, this card offers purchase protection and extended warranty coverage on eligible items purchased with the card.

Cardholders also have access to Amex Offers, which provide discounts and special deals on a variety of products and services from popular retailers and brands. Users can earn rewards points on their everyday purchases that can be redeemed for travel, merchandise or statement credits.

The American Express Essential Card is an excellent choice for anyone who wants a low-cost credit option with useful perks and benefits.

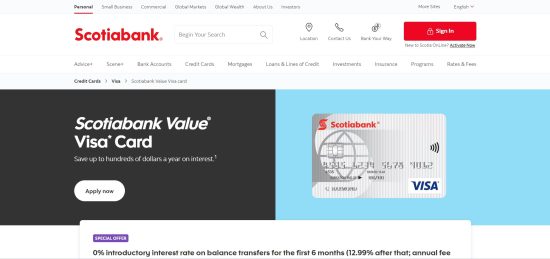

5. Scotiabank Value® Visa Card

The Scotiabank Value® Visa Card is a low-interest credit card that offers several benefits. It has an annual fee of $29 and an interest rate of 12.99% on purchases and cash advances, which can help you keep your interest costs down.

One of the main advantages of this card is its balance transfer offer, allowing you to transfer high-interest balances from other credit cards onto the Scotiabank Value® Visa Card at a promotional rate of 0.99% for the first six months. This feature can save you money in interest charges and help you pay off your debt faster.

In addition to its low rates, this card also provides insurance coverage for travel accidents, rental cars, and purchase protection. You can easily manage your account online or through the Scotia mobile app, making checking your balance or making payments convenient.

Suppose you’re looking for a no-frills credit card with low fees and competitive rates. In that case, the Scotiabank Value® Visa Card may be worth considering as it offers several useful features that can help keep your finances under control.

How to Choose the Best Low-interest Credit Card for You

Choosing the best low-interest credit card depends on your needs and financial goals.

- First, consider how you plan to use the card. If you tend to carry a balance from month to month, choose a card with a low ongoing APR.

- Next, look at any additional fees associated with the card, such as annual fees or balance transfer fees. Consider whether these costs are worth it based on how often you plan to use the card and what benefits it offers.

- Also, think about any rewards or perks that come with the card. While low-interest rates may be your top priority, having access to cash back or travel rewards can also be valuable.

- Research different options and compare their features side by side before making a decision. Look at reviews from other users and make sure that the issuer is reputable and trustworthy.

- Choosing the best low-interest credit card requires careful consideration of your circumstances and preferences. Take time to evaluate all factors involved before making a final decision.

Alternatives to Low-Interest Credit Cards in Canada

While low-interest credit cards are a great option for those looking to keep their interest costs down, they’re not the only solution. Here are some alternatives you may want to consider:

- Balance transfer cards: These types of credit cards typically offer 0% introductory APRs on balance transfers for a limited time. This can be a good option if you have high-interest debt on another card that you’re trying to pay off.

- Personal loans: If you have a large expense coming up, like home renovations or medical bills, a personal loan may be more affordable than using your credit card. Personal loans frequently include fixed repayment terms and lower interest rates.

- Home equity lines of credit (HELOCs): If you own your home and have built up equity, you may be able to take out a HELOC with a lower interest rate than your credit card. However, it’s important to note that HELOCs use your home as collateral and come with risks.

- Cash advances from friends or family: While borrowing money from loved ones isn’t always ideal, it can be an interest-free alternative to taking out high-interest debt on your credit card.

Consider all these options when choosing what works best for your financial situation before making any decisions on which one suits you better in the given circumstances!

Conclusion

Low-interest credit cards can be a great option for those who want to keep their interest costs down while still enjoying the benefits of having a credit card. With so many options available in Canada, it’s important to research and compare different cards to find the one that best suits your needs.

Remember to consider factors such as annual fees, rewards programs, and any additional perks or benefits offered by each card. And always make sure you read the fine print carefully before applying.

While low-interest credit cards are a good option for some people, they may not be the right choice for everyone. It’s important to weigh all of your options and choose the financial products that work best for you and your situation.

By following these tips and doing your research, you can find a low-interest credit card in Canada that meets your needs and helps keep your finances on track.

FAQs on low interest credit cards in Canada

1. Can you get a 0% interest credit card?

A credit card with a 0% introductory or promotional interest rate is known as a 0% credit card. You can spread out payments by paying less than the whole amount owed each month and still avoid paying interest. The usual rates will be applied to your card’s remaining balance after the deal expires.

2. What is a good credit card interest rate?

APR, which stands for Annual Percentage Rate, is a composite of various charges and interest you make in exchange for the ability to borrow money. Your credit score determines the APR you obtain; the better your score, the lower your APR. The current average APR for credit cards is 20%, which is considered to be an acceptable APR.

3. Is 10% a good credit card interest rate?

If you have decent credit, an APR on a credit card should be less than 14%. If your credit is excellent, you can be eligible for a rate as low as 10%. The best credit card APR, however, can be higher than 20% if you have poor credit.

4. What are 2 ways to avoid paying interest on a credit card?

- By paying the full statement balance by the due date each month, you can avoid accruing any interest charges.

- Many credit cards offer a grace period, typically ranging from 21 to 25 days. During this period, if you make a purchase and pay the balance in full before the grace period ends, you won’t incur any interest charges.

5. What credit score is needed for 0 interest?

Credit cards with 0% APR often demand strong or excellent credit ratings. This indicates that you’ll want a good credit score of at least 670 on the FICO scale or 661 on the VantageScore.