Are you a student in Canada looking for the best credit card to help manage your finances? Look no further! We’ve compiled a list of the top 10 best student credit cards available in Canada. These cards offer cashback, reward points, low-interest rates and other benefits that can make a big difference to students who are on a tight budget. Whether you’re looking for savings on groceries or travel rewards, there’s something here for everyone. So let’s dive into our list and empower your student finances with the perfect credit card!

Top 10 Best Student Credit Cards in Canada

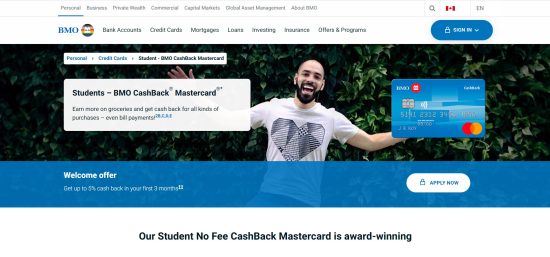

1. Student BMO CashBack Mastercard

The Student BMO CashBack Mastercard is a great option for students who want to earn cashback rewards on their purchases. With this card, you can earn 1% cashback on all of your purchases with no annual fee.

One great feature of this card is that it offers a welcome bonus of up to 5% cash back on all purchases made in the first three months. This means that if you spend $2,000 during the first three months after opening your account, you could earn up to $100 in cash back!

Another benefit of the Student BMO CashBack Mastercard is that it comes with basic travel insurance coverage at no extra cost. This includes coverage for emergency medical expenses and trip cancellation/interruption insurance.

The Student BMO CashBack Mastercard is a solid choice for students who want to earn rewards while building their credit records.

2. CIBC Aeroplan Visa Card for Students

The CIBC Aeroplan Visa Card for Students is a great option for students who love to travel. This credit card allows you to earn Aeroplan points with every purchase, which can be redeemed for flights and other travel-related expenses.

One of the best things about this student credit card is that it offers a welcome bonus of 5,000 Aeroplan points after your first purchase. This is a great way to jumpstart your point collection and get closer to your next adventure!

Another perk of the CIBC Aeroplan Visa Card for Students is that no annual fees are associated with it. As a student on a budget, this can be incredibly helpful in controlling your finances.

This credit card also comes with insurance coverage, such as emergency medical insurance and trip interruption/cancellation insurance. These benefits can provide peace of mind while travelling abroad or within Canada.

If you’re looking for a student credit card that rewards you with travel perks and has no annual fee, the CIBC Aeroplan Visa Card for Students may be worth considering!

3. BMO Air Miles Mastercard

BMO Air Miles Mastercard is an excellent choice for students in Canada who want to earn rewards while building their credit history. This card offers great value with no annual fee and a welcome bonus of up to 800 AIR MILES.

Cardholders can earn one AIR MILE for every $20 spent on eligible purchases, which can be redeemed for travel, merchandise or other rewards. Plus, the more you spend on your BMO Air Miles Mastercard each month, the more AIR MILES you’ll earn.

In addition to earning rewards, this card also offers valuable insurance coverage, including extended warranty and purchase protection. Cardholders can also access BMO’s convenient online banking services and fraud alerts.

If you’re looking for a student credit card that allows you to earn rewards while keeping costs low, the BMO Air Miles Mastercard is worth considering. Pay your balance in full each month so that interest charges don’t eat into your reward savings!

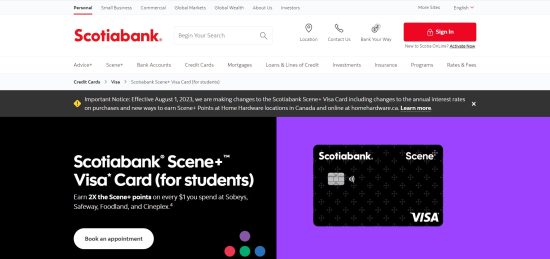

4. Scene+ Visa Card for Students

The Scene+ Visa Card for Students is a great choice for moviegoers who want to earn rewards on their purchases. With this credit card, you can earn 5x the points when you use it at Cineplex theatres and other participating merchants.

Not only that, but you also get a welcome bonus of 2,500 points after your first purchase. This can be redeemed for two free movies or $25 off your next theatre visit.

Aside from earning rewards on entertainment purchases, the Scene+ Visa Card for Students also offers 1x points on all other purchases. Plus, there’s no annual fee and no limit to how many points you can earn.

Another perk of this card is its extended warranty coverage which doubles most manufacturer warranties up to one year longer. It also includes purchase protection against theft or damage within the first 90 days after purchase.

If you’re a frequent moviegoer and want to earn rewards while enjoying your favourite flicks, then the Scene+ Visa Card for Students could be an excellent fit for you!

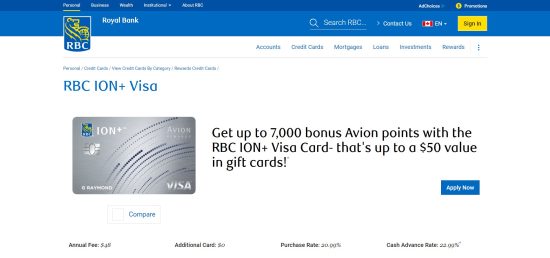

5. RBC ION+ Visa Credit Card

The RBC ION+ Visa Credit Card is one of Canada’s most popular student credit cards. With no annual fee and a low-interest rate, it’s easy to see why students choose this card.

One of the biggest advantages of the RBC ION+ Visa Credit Card is its cashback rewards program. This card offers 1% cashback on all purchases, which can add up over time. Plus, you’ll earn even more cashback when you shop at select retailers through RBC Rewards.

Another great feature of this card is its mobile app. You can use it to keep track of your spending, pay your bills, and even redeem your rewards points. It’s a convenient way to manage your finances on the go.

With RBC’s Zero Liability Protection and Fraud Detection Guarantee, you can rest assured that your money will be safe if anything goes wrong with your account. The RBC ION+ Visa Credit Card is a smart choice for any student looking for a reliable and rewarding credit card option.

6. American Express Cobalt Card

The American Express Cobalt Card is a popular choice among students in Canada. With its impressive rewards program, this card allows students to earn points on every purchase they make. The points can be redeemed for travel, merchandise or statement credits.

One of the best features of the Cobalt Card is that it offers 5x rewards on eligible eats and drinks purchases at restaurants, bars and coffee shops across Canada. This means that students can easily rack up their reward points by simply dining out with friends.

Another advantage of the American Express Cobalt Card is that it has no annual fee for the first year – making it a cost-effective option for students who are just starting to build their credit history. Additionally, if you spend $500 within your first three months after opening your account, you could receive up to 30,000 bonus points!

The American Express Cobalt Card is an excellent choice for student credit cards in Canada due to its generous rewards program and low introductory fees.

7. CIBC Dividend Visa Card for Students

The CIBC Dividend Visa Card for Students is an excellent option for students who want to earn cashback on their purchases. This credit card offers 2% cash back on groceries, gas, and Tim Hortons purchases and 1% cash back on all other eligible purchases.

One of the benefits of this card is that there is no annual fee. Additionally, students can take advantage of special discounts and perks from CIBC partners such as Avis Rent-A-Car and Budget Rent-A-Car.

Another feature that sets this card apart from others is its mobile payment capabilities. With Apple Pay or Samsung Pay, users can easily make payments using their phones.

However, it’s important to note that the interest rate for this card is quite high, at 19.99%. Therefore, paying off your balance in full each month is crucial to avoid accumulating debt.

The CIBC Dividend Visa Card for Students offers a great way to earn rewards while making necessary purchases like groceries and gas. Just remember to use it responsibly!

8. Coast Visa Student Low-Interest Rate card

The Coast Visa Student Low-Interest Rate card is a credit card designed specifically for students who want to improve their credit score while keeping interest rates low. This card offers an attractive variable interest rate of just 11.99% on purchases and cash advances, which is lower than most other student credit cards in Canada.

One great feature of this card is its easy online application process – you can apply from anywhere, at any time. Plus, the rewards program allows you to earn one reward point for every dollar spent on eligible purchases, which can be redeemed for travel rewards or merchandise.

Another benefit of the Coast Visa Student Low-Interest Rate card is that it comes with purchase protection and extended warranty coverage, providing peace of mind when making big-ticket purchases like electronics or appliances.

The Coast Visa Student Low-Interest Rate card is a solid choice for students looking to establish good credit habits while keeping interest rates low and earning rewards along the way.

9. Brim Mastercard

Brim Mastercard is one of the best student credit cards in Canada. This card offers a 1% cash back on every purchase, which can be redeemed for statement credits or merchandise. Additionally, Brim Mastercard provides travel protection benefits and no foreign transaction fees.

The card also has the unique feature of allowing users to earn bonus points on specific purchases made at partner retailers. These points can be used towards future purchases with those same partners.

Another great benefit of Brim Mastercard is its mobile app that allows easy tracking of spending and rewards earned. The app also provides notifications for eligible bonus point offers and personalized recommendations based on spending habits.

Brim Mastercard’s combination of cashback rewards, travel benefits, and user-friendly features make it an excellent choice for students looking to manage their finances responsibly while earning rewards along the way.

10. Neo Secured Credit

Neo Secured Credit is a great option for students who want to build their credit history. With this card, you can set your credit limit by securing it with a deposit, which means that even if you have no or a bad credit score, you will be eligible for this card.

One of the best things about Neo Secured Credit is its low-interest rate of 19.99%, which makes it easier to pay off your balance each month without accruing too much interest.

In addition to the low-interest rate, Neo also offers cashback rewards on every purchase made with the card. You can earn up to 1% cashback on all purchases and up to 4% cashback at partner merchants.

Neo Secured Credit is a great choice for students who want an easy and accessible way to start building their credit history. The combination of low fees and generous rewards makes it an excellent option for anyone looking for a student credit card in Canada.

How to choose the best student credit card?

Choosing the best student credit card can be overwhelming, especially for first-time credit card users. Before making a decision, it is important to consider your financial goals and spending habits.

- Find a student credit card that doesn’t charge an annual fee. This will help you avoid unnecessary charges as you build your credit history. Additionally, compare the interest rates of various cards to find one that offers low or no interest on purchases and balance transfers.

- Consider also any rewards programs offered by the card. A cashback program may be more beneficial if you spend regularly at certain merchants or on specific categories such as groceries or gas. Alternatively, if you are an avid traveller, choose a card that offers travel points or miles.

- Do not forget to read all terms and conditions carefully before applying for any student credit card. Ensure there are no hidden fees or penalties associated with late payments or exceeding your limit. Always remember to use your credit wisely and make timely payments each month to maintain good financial health!

Conclusion

Choosing the best student credit card in Canada is an important financial decision that can greatly benefit your future. With so many options available, it’s crucial to consider your spending habits and financial goals when deciding which card is right for you.

Whether you’re looking to earn cashback rewards or travel points, a student credit card can help you achieve those goals while also building your credit history. It’s important to remember to always use your credit responsibly and make payments on time to avoid high-interest rates and fees.

By doing your research and selecting the best student credit card for your needs, you’ll be well on your way toward empowering your finances as a Canadian student.

FAQs on student credit cards in Canada

1. Is it hard to get a credit card as a student?

Student credit cards often have smaller credit limits and ordinary to high APRs. However, they occasionally offer flexible credit conditions for approval. However, the student can apply on their own and, normally, receive approval if they can confirm their college enrolment and some kind of income.

2. What are the disadvantages of student credit card use?

The main advantages of student credit cards are their quick acceptance, ability to establish credit, and potential for greater rewards, interest rates, and fees than those offered by non-student credit cards for people with no credit. Low credit limits and the potential to increase your student loan debt are the two greatest drawbacks of student cards.

3. Do student cards affect credit scores?

Your credit score is unaffected by a student loan. Additionally, it does not show up on your credit record. If you ever need to seek financing, the lender won’t know you have student debt until they specifically ask on the application.

4. Do student credit cards build credit slower?

No, student credit cards don’t help you develop credit more quickly than any other kind of card. Most credit cards, especially student cards, send monthly reports to at least one of the three main credit agencies, so using your card responsibly and making on-time payments will raise your credit score over time.